On average, Americans paid $15,322 in federal income taxes during 2018. Add up all our other taxes—state income taxes, sales taxes, and property taxes, and it's easy to feel like most of your income is going into the government's pocket–and for what return?

Of course, how much of your income actually goes towards taxes depends on multiple variable factors, from your income tax bracket to where you live to how you choose to manage your wealth.

While most states levy income taxes, Texas is one of the exceptions. Your overall tax bill may be one thing about Texas that isn't bigger than other states. Many sources will tell you Texas levies one of the highest property taxes in the country, but you've got to step back and look at the big picture.

The recent news is telling. Several reports have discussed how many people are migrating to states like Texas. Most notably, evidence of population migration is apparent in how California lost a house seat while Texas gained two. A noteworthy population shift began last decade from high taxation states to the more affordable, more temperature climates in the South. People are escaping the crowded, overpriced Silicon Valley and Los Angeles for Texas's employment and economic opportunities.

It's not just Californians packing up. US census data shows Texas is drawing in more people from numerous states and countries. The most recent data from 2019 shows that Texas gained 559,661 new residents. The top states sending new residents? Outside of our border states, we gained the most from New York, Illinois, Georgia, Florida, California, and Arizona.

The pandemic spurred an increase in outmigration as at-home workers became fed up with dense urban environments lacking outdoor space, overpriced interior space, and the ability to enjoy what a major city could offer.

Why are people moving to Texas?

Quality of life

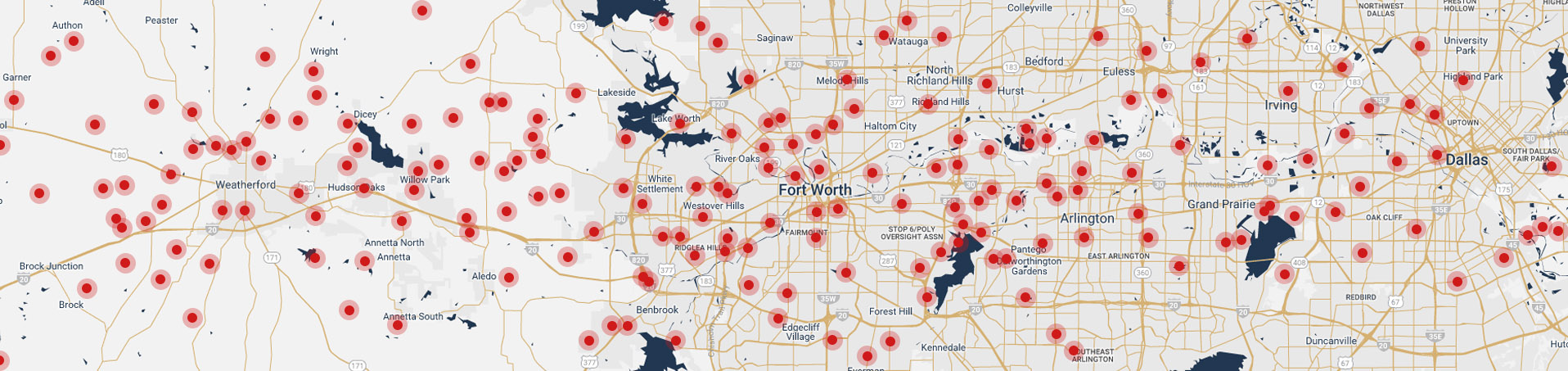

A big part of Texas' draw is the quality of life our state can offer. We're a state of sprawling communities. Single-family homes often have yards or are in proximity to parks and recreation. Media stories like this one highlight the bigger square footage available in Texas homes. The average square footage of a Fort Worth home built 2010-2016 was 2,166, an increase of 64%.

Housing costs

The financial incentives are another big advantage. Numerous northern and eastern states are simply becoming too expensive for people to live. The average rent for an 808-square foot apartment in Boston in May 2021 was $3,143; in Los Angeles, they paid $2,376 for 792 sqft. That's just for a living space, not the utilities, transportation, or grocery cost. It's no wonder more young professionals and retirees are moving into states where the cost burden is lower.

People moving to Texas find that their dollar simply stretches further. Not only can they buy more real estate for the same expense, even adding a backyard or an extra bedroom, but their health care and their overall cost of living are reduced.

Tax deductions

Speaking of real estate, changes to the SALT deduction have been a big motivator for homeowners in high-income tax states to seek homeownership elsewhere. This deduction capped state and local tax deductions claimed on federal taxes to $10,000. In high burden tax states like California and New York, that put a major increase on the amount of taxes owed or reduced the refund received by these taxpayers.

The previous tax code allowed these taxpayers to itemize instead of taking a standard deduction, helping them deduct all the property taxes they paid to their state and local government agencies and their sales taxes or individual income taxes.

People were left owing more money, and they didn't like that.

Real estate prices

Another motivator is the price of real estate. Texas median home prices offer more value compared to some of these other states. According to Experian, in 2021, the Texas median home value was $199,900. In California, the median home value was $550,800. Texas was also cheaper than Florida at $237,900 and New York at $305,000.

Of course, the actual value of housing prices will vary greatly by where you live. In Fort Worth, the median housing value in May 2021 was $275,000, a 13.4% increase over the prior year. The same is true if you look at specific cities like San Francisco and New York City, which have higher median housing values. However, this median housing value is still lower than the May overall median value for United States single-family homes.

Why live in a low tax state?

The most immediate and obvious answer is that life in a low tax state will save you more money in the long run. Making a move can save you substantial money when it comes to your income taxes.

One financial adviser found that accounting for similar expenses, some of his clients couldsave $100,000 in taxes over 25 years by leaving California for a state like Texas.

The drawbacks of a low-tax state

You need to recognize that the government must have some way of balancing its budget if it's not levying income tax or substantial property taxes. In many cases, the state government makes up the difference using sales taxes. Municipalities and counties can add a sales tax on top of any state tax, increasing the burden in specific areas.

While the state may have a higher sales tax burden, remember, you can control your purchasing. If you're someone who doesn't tend to buy many goods, is resourceful at finding deals, or is savvy with a budget, moving to a state with a slightly higher sales tax and no income tax could work in your favor.

About the Texas tax load

The State of Texas Constitution does not allow for personal income taxes. It is one of the few states that does not have a personal income tax. The others include Florida, Washington, Wyoming, Nevada, South Dakota, and Alaska. New Hampshire and Tennessee do not have a personal income tax, but residents have to pay tax on income from investments and dividends.

Taxes on retirement income

For retirees, having no state income tax means that Social Security retirement benefits and other forms of retirement income are tax-free. When you're living on a fixed income, this can be a good thing.

Texas sales taxes

Texas uses sales taxes and use taxes to make up the financial difference, along with local taxes and property taxes. In some jurisdictions, these sales taxes can be as high as 8.25%. Fort Worth is one area with an 8.25% sales tax rate.

Texas Property Taxes

Property taxes in Texas are known to be some of the highest of any US state. That's why it's essential to look at the overall tax burden of living here. Once you factor in what you would pay in your personal income tax and sales taxes, spending more through property tax may not be such a big deal.

Plus, housing is another area where you can control what you spend to a degree. As a homeowner, you decide your housing budget, including property taxes and home insurance. A competent real estate agent will have you consider the whole financial picture of homeownership as you set your home purchase budget.

Something else to keep in mind about Texas property taxes is that the tax is collected by cities, counties, and school districts and not by the state. Your tax rates will vary according to the county and the city that you choose to live in. Those taxes that you pay can only be used for local needs. Effectively, your property taxes are paid to your surrounding community.

Texas property taxes are based on your real estate's current assessed market value and income-producing tangible personal property. Your appraised value is multiplied by the local tax rate to figure out your tax bill. These tax rates are set by the counties and school districts based on their yearly budgets and how much revenue they need to cover their costs. There are also homestead exemptions, exemptions for seniors and the disabled, and for disabled veterans.

You can figure out the Tarrant County current tax rate for the area you are looking at by going to the tax assessor website. The information there breaks down the taxes they collect, and it offers a tax estimator.

Texas inheritance taxes

More good news for retirees and their heirs is that Texas has no inheritance tax or estate tax. You may still have to pay federal estate taxes if your estate values at more than $11.7 million as of 2021.

Texas sales taxes

Texas levies a sales tax of 6.25%. Local counties and municipalities can also add their own sales tax. This can bring the local rate up to 8.25%, but regulations prevent it from rising higher than that number. Fort Worth is one of the cities carrying a total sales tax rate of 8.25%.

One thing to note about the Texas sales tax is it does not apply to a few essential goods, like unprepared food items like produce from the grocery store, prescription drugs, and over-the-counter drugs. Factor this in when considering your cost of living.

Other miscellaneous taxes

There is a hotel tax that is 6% of the accommodation cost. For entrepreneurs, the franchise tax on businesses runs from .375-2.75% on any revenues over $1.18 million. The Texas gas tax is $0.20 per gallon. There is no individual income tax or personal property tax unless that property is used for business purposes. The county districts set this personal property tax.

How does the Texas tax burden compare?

The overall tax burden of living in Texas is 8.2%. The state ranks 23rd for overall taxation affordability. While we may not be exceptionally low in terms of the tax burden, we are better than half of the states.

When you look at where the other states stack up regarding their tax burden, Alaska has the lowest tax load on its residents. However, it's also one of the least affordable states to live in–not to mention the frigid weather! The inaccessibility of goods and transportation takes a toll on the state's price of goods and services.

Florida, a state that analysts often compare with Texas, may have the 5th best tax burden, but it ranks 35th for its affordability. Of the no-income-tax states, South Dakota and Tennessee are the only two more affordable to live in than Texas, with Tennessee ranked just above our state.

What are the benefits of living in a low tax state?

The assumption behind living in a low tax state is that you will earn and save more money over the years because it's going to you and not tax payments.

A report from the American Legislative Exchange Council says that the nine stateswithout a personal income tax have outperformed the nine states with the highest personal income tax in terms of GDP growth, employment growth, and in-state migration.

In their comparison, data from 2006 to 2016 showed that the population growth rate was 11.9% compared to 5.6% between these low-tax and high-tax states. The Institute on Taxation and Economic Policy pointed out that these low-tax states have actually struggled to add enough jobs to keep pace with their growing populations.

Note that everyone agrees with the ALEC findings.

Something else to point out is that according to Investopedia, of the no income tax states, two of them were ranked the two best states to live in. While we can't pinpoint a lack of income tax as the sole reason they were ranked the best, there is some perceived benefit to not paying income tax.

Choosing to live in Texas

Besides the taxation rate, why would someone choose to live in Texas and the Fort Worth area specifically?

Fort Worth is a great place to live because not only does your dollar stretch further in terms of housing compared to other major cities, but you are close to urban amenities and outdoor recreation.

Spend your week working hard downtown or catching a flight from Dallas-Fort Worth International Airport to your work destination. Fort Worth is home to several major companies like Lockheed Martin, American Airlines, Alcon Laboratories, the Fort Worth Independent School District, and NAS.

Spend your weekends at Eagle Mountain Lake, Lake Granbury, or one of the other state parks within a days' drive of the city. With Texas wine country at your doorstep, you have the numerous wide-open fields and charming towns of central Texas ready to explore.

Fort Worth also has a strong arts and culture scene. Our Botanical Gardens are recognized for their diversity and research work. In the Museum District, explore artistic masterpieces from across the globe at the Modern Art Museum or the Kimbell Art Museum. Fort Worth's history as a cattle town also colors the cultural events. Experience daily cattle drives in the Stockyards National Historic District. Or, get a taste for country music and rodeo at iconic attractions like Billy Bob's Texas.

Families are not sacrificing quality education to live in the Fort Worth area. There are several Independent School districts that rate highly and have well-regarded schools not just on the state level but also nationally. We also have some top-ranked private schools. Texas Christian A&M university is inside Fort Worth, but our proximity to Dallas also gives us access to higher education options at the University of Texas campuses.

Take advantage of low-tax living

If you're considering making a move to a low tax state, don't let warnings of higher property taxes eliminate Texas from your possible list to live. Look at the overall tax burden and what you could stand to gain by living in a state like Texas. We are highly diverse in the activities and lifestyles we offer residents. With our temperate weather, there are things to do all year-round. Explore Fort Worth with the Chicotsky Real Estate Group to find the right neighborhood for your lifestyle.