Rental ownership is an attractive way to build or diversify an investment portfolio while creating an income stream. But like any investment, owning rental investment properties comes with risk. The shows you see on HGTV and TLC make rental properties sound like an easy prospect. Talk to anyone who owns and manages rental properties, and they’ll tell you it’s never as simple as television makes it out to be.

Before you do anything– and especially before buying that first rental investment property–you must get educated. Reading this is the right first step. Rental investment isn’t something to step into blindly. Your best chance of success are to learn everything you can before starting the search for properties.

As someone who’s counseled other real estate investors, here’s everything to do before buying your first investment rental property.

#1- Read all you can about real estate investing

Read as many articles and books about real estate investment as possible. Investors take different approaches on their path to success. Learning different viewpoints allows you to find a strategy that fits with your goals and your lifestyle.

#2- Research how to be a landlord

Rental ownership means you’ll take on the role of landlord. Screening prospects, conducting maintenance, collecting rent, evicting tenants: you must be well-prepared to execute these tasks. Know the latest guidelines for rental properties in Fort Worth, from what you can legally charge for rent, how to raise the rent, and how to properly conduct an eviction in Tarrant County. Explore Section 8 and Housing Assistance, even if you don’t intend to fall under these programs. There’s no such thing as too much knowledge when it comes to investing in real estate and operating as a landlord.

#3- Talk with other investors

After reading, your best source to learn about rental investing is the people doing it now. Get their advice, not just on things they wish they knew before they started, but on the nuts and bolts of managing the properties. How do they handle rent collection? Do they have a contractor or property maintenance firm they trust?

#4- Run a Pro/Con Analysis

You need to balance the possible risks and rewards of real estate investment. The risk may not make sense to you at this time in your life. For example:

- Are you able to handle tenant emergencies at any time?

- Can you float the rental investment if you do not have enough tenant income for a period of time?

- Are you able to hold the property if you can’t sell it quickly?

- Do you have enough cash to make a real estate investment purchase?

The rewards are alluring. In the long-term, real estate values tend to be more stable than investing in stocks. Even when the market is on a down cycle, if you hold onto the property long enough, chances are you’ll still gain value. In the short-term, it’s a way to earn money while still making income from your regular job. Rental income should grow over time to reflect the appreciating value of real estate.

But rental income isn’t guaranteed. Tenants come and go. The property may be vacant for a time. You could also see an increase in property taxes, as the investment property loses its homestead exemption.

As you can see, there’s a lot to consider about real estate investing. If you believe the rewards outweigh the risks in your case, continue with your education.

#5- Know your target audience

Occupied rentals means cash flow! A deep rental pool is crucial to keeping your rental property occupied. Instead of finding the ideal home and expecting renters to flock to it, start with a renter profile and find the ideal property to match.

The best investment properties are located in situations that attract your ideal client profile.

Example: You plan to rent the property to students at Texas Christian University. This means the ideal home is located near the campus. Students will want a place with affordable rent. What you charge for rent is more restricted by a college student’s cash flow, although the students may have parent financial support. You’ll need to find a low-cost property with low overhead to make renting to students worth your while. Look for durability, like flooring that can take a lot of wear-and-tear and yards with easy landscaping.

But what if your ideal tenant(s) are young professionals? Young families? Their tenant profile changes what they want in a property.

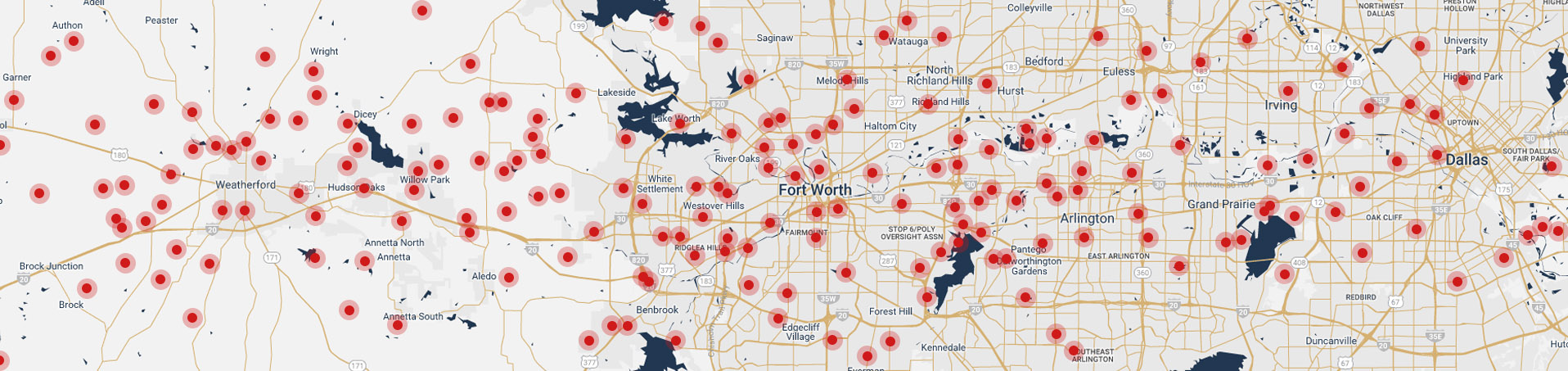

#6- Know your real estate market

Use an analytical approach based on financial factors when studying the real estate market. Inevitably, your purchase is about the hard numbers. Where can you purchase a property that is likely to attract and keep tenants while bringing the maximum return on your investment?

Real estate markets change all the time. When you’re interested in real estate investing, you need to stay apprised of what’s going on even when you’re not buying or selling. Trends tell us plenty about the market.

It’s not just Fort Worth to pay attention to. Individual neighborhoods have their own cycles. Transitional areas, or neighborhoods undergoing revitalization, are a tempting gamble. You could score a good deal that yields a high return on your investment a few years down the road. Or, the revitalization attempt could fail and stick you with an underperforming real estate asset. Again, it’s balancing risk and reward.

A common refrain in real estate investment advice is to invest where you know. Get a property in an area you are familiar with, or even live. Are the homes around you a good rental investment option?

#7- Know your numbers

Real estate investors make smart choices when they understand the metrics used to analyze properties and the rental market. One metric is the capitalization rate. This measures a real estate investment’s profitability and return potential. The rate is calculated by dividing the property's net operating income by its current market value. The cap rate works best if the property has already been used as a rental.

Another factor is how many properties are rented in the area and their absorption rate. An area with a high ratio of rental properties to homeowners signals there could be a lot of tenant turnover. The absorption rate measures how long it takes all the rental housing in a given area to sell or rent. The higher the absorption rate, the longer properties stay vacant and on the market. A high absorption rate bears investigation before purchasing a rental investment in the area.

#8- Bring in a real estate agent

Real estate agents work with real estate investors all the time to achieve their goals. We have access to more data about the market and trends than the general public. Our job is to stay in tune with market shifts. We know where people are looking to live. We advise on up-and-coming areas where you could make a hot buy. Our network ties us to investors who might be ready to sell you their rental-ready off-market property.

With our market knowledge, data, and information about your real estate investment goals, we make recommendations on wear to look to secure the best deal for you. Our negotiation skills come in handy when getting the right terms on your purchase agreement. Picking a real estate agent to be in your corner is an asset to take your time selecting because ideally, you’ll start a long-term working relationship with them.

#9- Run the numbers beforehand

At this point, you understand your role as a real estate investor, researched the current market, spoken to investors and a real estate agent. Now you’re feeling confident in your decision to take on a rental investment property. Time to run your numbers.

How much money do you have available to make your down payment and what do you think you could borrow to make your first investment property purchase? Now factor in expenses like closing costs in home renovations. Estimate your rental price and deduct the operating costs in mortgage costs. Think about how long you plan to own the property and how much appreciation in value you expect. Look out into the long-term. How much profit do you expect to make from this experience?

Chances are, you may not get close to hitting this anticipated profit margin. But running this calculation is essential before making the purchase. It gives you something realistic to shoot for.

A detailed analysis of your investment numbers helps you recognize you need to invest enough of your cash to produce a positive cash flow. You don't want your rental Investments to be net neutral, where your rental income is enough to cover all the monthly expenses like mortgage payment, landlord insurance, and maintenance. You need enough wiggle room to survive the unexpected, both in damages and in market fluctuations.

Finally, you need to walk into the property with an expected return. For every dollar you invest in this property, what will you net when it is time to sell? Investopedia considers a six percent return healthy for a first-year investment.

Another tactic is the 1% rule. Whatever you buy a house for, each month it needs to bring in 1% back. Simply put, a house purchased for $150,000 should bring back $1500 in rent.

#10- Alleviate your debt

The point of rental property investing is to generate income for you. But it's not going to improve your financial situation if you're already carrying a lot of debt. As a first-time real estate investor, chances are you’ll need an investment loan to purchase a rental property.

Do reduce or eliminate your debt before building your real estate portfolio. This includes medical bills, student loans, car payments, and anything else you might be carrying. A lower debt-to-income ratio for you improves your chances of securing better loan terms and actually generating income from the real estate investment.

Remember, rental properties always have unexpected costs. As the owner, critical repairs will fall on your shoulders. You'll need extra cash as a cushion to cover these unexpected expenses.

The last thing you want to do is make yourself financially unstable. It's one thing if taking on the rental investment property will put you in a better financial position. But if you can't make the payments on your debt, including floating your new rental property when it's vacant, you're putting your financial future in jeopardy.

#11- Dig down into location

Location is everything. You need your property to be in a place that renters want to be.

The best rental properties will be in areas with good schools, low crime rates, close to amenities, and a solid job market.

If you don’t personally know the area, spend some time there. Get familiar with it. Drive around at different times. Talk to shop owners and local property managers.

Make sure wherever you buy the rental property, it is in a desirable area even during economic turndown.

#12- Research mortgages

While you don't need 100% cash to start your first rental investment property purchase, you do need a pretty solid nest egg. Since this property will not be your primary residence, the majority of lenders require at least 20% down payment for buying an investment property. You may be facing higher interest rates. Your best bet is to find the lowest mortgage payment possible to build equity in your new investment property without paying too much interest back to the bank.

#13- Do you need that partner?

Investing in real estate earn you money or it could be a disastrous experience. The same is true of going into real estate with a partner. First-time investors sometimes consider bringing in a partner to reduce the risk and the need for an investment loan.

Having a partner can complicate the process. It needs to be treated as a business agreement, even if you are going into the investment purchase with family. Come up with an official agreement before purchasing the property.

#14- Have your team in place

It's fine to have a do-it-yourself approach to the upkeep of your first rental investment property. Just make sure you're the kind of person who's actually comfortable with a hammer and screwdriver. Otherwise, have a solid team available to assist with your property. Find reputable handymen, cleaners, landscapers, and contractors. Another option is a property management company that handles the majority of the rental and maintenance process for a fee.

#15- Think carefully on your first real estate investment property

Avoid the temptation to go all-in on your first real estate investment purchase. A smart rental investment property buy would be cautious for first go-round. This gives you an opportunity to exit safely if you feel you're too far over your head. A conservation purchase also gives you an opportunity to learn from the experience if you choose to move forward and expand your real estate investment portfolio.

So, what should you do for your first real estate investment purchase?

General advice is to go with some low-cost properties. They don't necessarily have to be fixer-uppers, but something in the low and mid-range price brackets that gives you enough wiggle room to save cash for renovations. Plus, a lower-priced home reduces your investment risk even if you don't reap a ton of profit.

Some people feel your best bet for a first-time rental investment property is a single-family home. Their reasoning is that it's much easier to upkeep one house than to upkeep a multi-family or commercial property. A single tenant reduces the wear and tear on the home.

Another option at your disposal is to purchase a multi-family property that you can also live in. These are duplex, triplex, and fourplex properties. This situation allows you to be on hand to address any problems with the tenants. In some situations, you may be able to live for free while building your equity and creating an income stream.

Another way to trial your role as a landlord is to purchase a second vacation property. Use the home when you wish, and turn it into a rental on Airbnb or VRBO while you’re gone. As long as your local zoning and boundary laws allow you to turn it into a vacation rental, this can be your first foray into what it is like to rent a home and produce some income.

The final consideration is how much time you want to invest before putting the property on the market as a rental. Buying a rental investment property already occupied with tenants allows you to you start producing income for right away. And if the property is not occupied, buying something already ready to rent allows you to close the deal and market it right away. Remember, the more days not occupied with the tenant, the less income you make.

Shows like Fixer-Upper and Property Brothers make it look easy to buy a house at a bargain and fix it up. Sing about full-scale renovation is if you don't know what you're doing, it gets expensive fast. It also takes way more time than you would expect. As a first-time rental property investor, your best bet is to purchase a property that needs only minor repairs.

#16- Beware the emotions

Rental investing is running a business. You may think you’re cool and level-headed, but starting a new venture is exciting. Everyone has high hopes when they launch a new business. It’s easy to want to jump head-first into your role as landlord and real estate investor

Do not let emotion impact your judgment when buying your first rental property. The better you can source a solid first deal, the higher your chances of reaching your investment goals.

Are you ready to consult a real estate agent?

One person we definitely want you to talk to you is a Fort Worth real estate agent. Chicotsky Real Estate Group works with real estate investors all the time on finding the right properties to achieve their goals. We serve as an asset at multiple touchpoints during your real estate investing journey. Let us be your source of local real estate market information.