Homes play an important role in our lives. They’re places we start families, turn over new leaves, make memories, and give comfort and care. Deciding to put down roots by purchasing a home is a significant decision.

Television shows like those playing on HGTV and TLC glamorize the home-buying and ownership process. The reality is home ownership is not a responsibility to take lightly. While the Chicotsky Real Estate Group hopes you do find a dream home to fill with wonderful memories, home ownership is work. On top of the financial commitment, residential properties need maintenance and work to keep them in a livable condition.

We view it as our responsibility to educate people on the ins and out residential property ownership, whether they are a first-time home buyer or a real estate investor. There are numerous factors to consider before taking first steps towards residential ownership. You’ll need to learn specific vocabulary and gain an understanding of the buying process. This knowledge will help you decide if home ownership is the best decision for you.

What to consider before buying residential property

#1- Why do you want to buy?

Never buy a home to keep up with the Joneses or because Uncle Sam told you rent is just throwing money away. In some cases, renting is the best choice. Home appreciation is never a guarantee and depends on extenuating factors. Even if you are feeling the pressure to buy because you've heard it's a buyer's market, take a step back and ask yourself if you want the responsibility inherent in home ownership.

Only buy a home under these conditions: 1) you really want to be a homeowner, 2) you plan on putting roots down in that space for a few years, and, 3) you are financially ready for the investment.

#2- The location

One question a real estate professional will ask is the neighborhood or the area you want to live. You need to know what kind of lifestyle you want. Research neighborhoods that match that particular lifestyle.

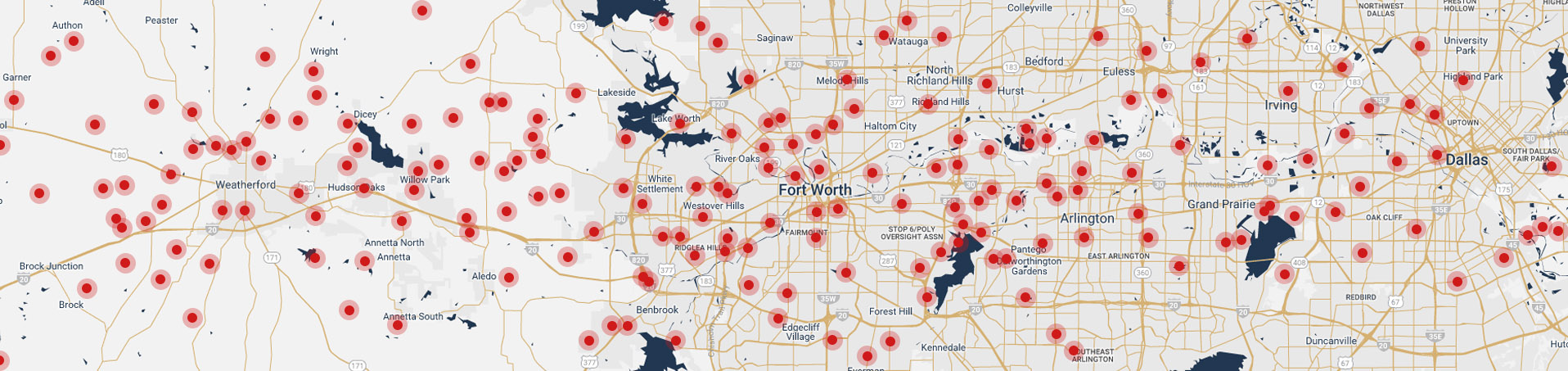

For example: if you want to become a single-car household, you need to be within walking distance of vital amenities and/or a place of employment. People who travel frequently for work want an easy drive to the Dallas-Fort Worth airport. Other people value access to recreation, so they would like to live near a specific park or have several acres of land. We often hear families say they want to live in the neighborhoods close to specific schools.

A local real estate agent takes your lifestyle wants and recommends the best locations for you.

#3- Affordability

Understand there are more expenses behind buying residential property than just the monthly house payment. You should never feel like you have to break the bank to make ends meet.

Home ownership comes with property taxes, regular maintenance costs, and unforeseen expenses. Before buying a home, know your debt-to-income ratio. Different industry professionals throw out different ideal ratios, but generally speaking, you don't want your DTI to exceed around 36 percent. This means all your existing financial obligations–car loans, student loan payments, credit card payments, medical bills–shouldn’t exceed this figure.

Add to the DTI the potential monthly house payment, which ideally would not exceed 30 percent of your current income. Combined together, your DTI and your house payment still need to leave room in your budget for utilities, groceries, and other bills. When you start crunching the numbers, you may find home ownership is not ideal at this time.

#4- Personal goals

After you purchase a home, what's the end game? Chicotsky Real Estate Group works with home buyers seeking their forever home, others looking at a first home, and some who want to fix-and-flip a residential property. Each of these goals requires a different approach.

When it comes to finding a dream home, we're going to be more careful and wait for the right opportunity. First time home buyers may be limited by their budget. Home renovators want a good deal in a hot neighborhood.

We caution against looking at your home purchase as a capital investment. While real estate is an appreciating asset, the recession of 2007 is never far from memory. The market is cyclical, with ups and downs. The longer you hold on to the home, and if you maintain it in good condition, the more likely you will gain some value from it. However, appreciation is never a guarantee.

#5- Mortgage rates

The majority of homeowners will apply for a mortgage to finance the purchase residential property. Many buyers are mistaken in thinking that the Federal Reserve sets the base interest rates that impacts mortgage rates.

Mortgage rates actually depends on the price of Mortgage-Backed Securities (MBS), and these are bonds backed by United States mortgages. These rates can change with little or no advance warning. The Mortgage Reports is a resource that explains how mortgage rates are set and how they vary.

Interest isn’t all you’ll pay with a mortgage. The closing cost represents what you will have to pay for securing the loan. You can shop for your mortgage rate based on the particular rate you want or particular closing cost you want.

Terms to know when buying residential property

Every industry has specific vocabulary and acronyms to explain commonly used concepts. Real estate is no exception. Before buying a home, it's important to educate know these terms so you better understand what your real estate agent and mortgage lender are talking about.

#1- Multiple listing service (MLS): A computer-based service that provides details of homes available on the market.

#2- Comps: A slang term for “comparables”, this is information on recently sold properties similar to the potential home you are looking at. They help appraisers find the fair market value.

#3- Common interest development (CID): Also known as Community Interest Development, these are shared areas managed by homeowners associations. Members usually pay monthly association dues. Examples of the CIDs include swimming pools, community centers, or landscaping.

#4- Deed-restricted: The deed for the property includes covenants they require for the property and structures to meet specific standards. These range from easements to what colors you can paint your home.

#5- ARM and fixed-rate: These terms refer to two different types of mortgages. A fixed-rate mortgage is a home loan that charges the same interest rate for the loan’s duration. An adjustable rate mortgage (ARM) charges less interest initially and more as the due date approaches.

#6- Pre-qualification letter: A note from your mortgage lender or bank estimating how much you can borrow to buy a home. It signals the buyer you are serious about your contract offer.

#7- PITI: This acronym stands for Principal, Interest, Taxes, and Insurance. It is all the expenses that go into a mortgage payment. When deciding on a budget for your home purchase, keep the total PITI in mind. Remember taxes go up every year and homeowners insurance can vary, so your PITI does fluctuate year-to-year, but rarely down.

#8- PMI: Buyers providing a down payment less than 20 percent of a residential property’s purchase price will need to secure private mortgage insurance, or PMI.

#9- Loan-to-value ratio (LTV): the amount of your mortgage compared to the home's appraised value, expressed as a percentage. The higher the LTV, the higher the interest rate on your mortgage.

#10- Earnest money deposit: A small payment proving your commitment to entering a real estate purchase contract. The EMD is put down during the purchase offer. The seller keeps the EMD if the buyer fails to uphold their contractual agreement.

#11- Escrow: After a purchase agreement has been reached between buyers and sellers, a neutral third party holds the EMD funds and documents until the closing of the sale.

#12- Rate lock: A bank agrees to honor a specific mortgage rate for a set number of days. The lender will close your loan at this agreed upon interest rate before the expiration date.

#13- Contingency: These are clauses added to a purchase contract that alter or void the purchase agreement. Common clauses include provisions for securing financing, a home inspection, or for the sale of the buyer's current home.

The residential buying process from A to Z

Be prepared for the real estate process to go on at least several months. Typically, the process lasts longer. First steps actually begin when you start thinking about potentially purchasing a home and not when you start looking or hire a real estate agent. In this early phase, you'll make essential steps to prove you are ready for the financial responsibility.

#1- Check your credit score

The better your credit score, the better mortgage rate you can secure. All three of the major credit reporting agencies (Experian, TransUnion, and EquiHYPERLINK "https://www.equifax.com/personal/"fax) allow you to pull a credit report free once every 12 months. The reports give insights into how to improve your score. Taking these measures can be an early first step in the home buying process. It may take a while to bump your credit score to sufficiently secure the best mortgage rates.

#2- Create a budget

Take a hard look at your finances. It's recommended you should not spend more than 30 percent of your gross income on housing expenses. This is going to include your home insurance and property taxes. This figure is the recommended maximum. Never bank on a promotion or pay increase; life happens to everyone.

Buy the home you can afford today, not the home of tomorrow. Smart buyers will leave some wiggle room for emergencies by spending less than the 30 percent total on their housing expenses.

The second budget consideration: How much money do you potentially have saved for a down payment? It is not advised to dip into your emergency savings to finance a down payment. If you do have less than 20 percent saved for a home purchase, it is not the end of the world. There are mortgage programs and lenders that accept down to 3 percent for a down payment. The trade-off is you will need to have private mortgage insurance, which can be 0.5 to 1 percent of the loan.

#3- Save for down payment & closing expenses

After studying your budget and finances, you may decide to save more money for closing costs and a down payment. How long this will take depends on your situation.

While you are saving for a down payment, first-time home buyers sometimes forget about closing costs. Some uneducated residential property buyers are shocked by how much it costs to close a real estate transaction. It’s common for these costs add up to several thousand dollars.

#4- Collect your paperwork

As the time start earnestly searching for a home draws nearer, start to collect all the paperwork that you will need to verify your finances for a mortgage loan. These include recent pay stubs, bank statements, credit card statements, W-2s, and tax returns.

#5- Start mortgage shopping

Numerous resources are available for finding the right home loan. You may qualify for special programs, like those from the VA and the USDA. Even if you don't, it's smart to talk to banks and lenders before looking at residential properties.

A web search will find free mortgage calculators that allow you to experiment with different down payments, mortgage interest rates, and programs to see how they change your monthly payment.

Analyze the current mortgage rates in the different programs available to you. Get an idea for which lender and program will be the best for your needs. Obtain a pre-qualification letter to know how much financing you qualify for. This letter will strengthen any offer you make to a buyer.

#6- Hire a real estate agent

Your best advocates in the real estate process will be a qualified real estate professional. The right agent will assist you in finding lenders, property appraisers, title companies–not to mention the perfect home! Real estate agents spend a lot of time studying their markets, getting to know their neighborhoods, in building connections. Sometimes they find the right home for you before it officially comes to the market.

The real estate agent will be working for you, so you want to spend some time finding one with the right level of expertise and work ethic. You want someone whose personality gels with you. Once you have found the right person, the real estate agent will ask you to sign an agency contract that states they work for you for the express purpose of finding a house that meets your criteria.

#7- Create a home buying checklist

Before looking at residential properties, distinguish between your wants and your needs. A want is something that would be nice to have, but is not a deal-breaker. An example of this is a fireplace: it's nice to have, but you can probably live without it. Contrast that to a need, which is something you would consider non-negotiable. An example of this would be a single-level house versus a multi-story house. Or, if you work from home, you might need an office space.

Help your real estate agent find your right home by sharing this checklist. Experienced professionals should ask questions about your needs versus wants anyway, but it's always good to have them in writing and to bring this checklist with you as you look at homes.

#8- Research the local real estate market

Once you determine how much financing you qualify for, and you have a home buyer checklist, start looking at the market. Your real estate agent knows if your desires and price point make sense for your target market. Unfortunately, sometimes what is available on the market does not match the buyer’s price point. An experienced real estate agent will find the best alternatives to fit your budget. The last thing you want is to fall in love with a home you can’t afford. That's another reason why hiring the right real estate professional is so important.

A real estate agent is your best market resource and they can tell you how different features add to a home's value. This matters if you have plans to sell this home within five years.

#9- Be available to look at homes

Not only will the right real estate agent stick within your goals, but they will find you hidden gems. This means they might ask you to go see a house that's going to come on the market soon. They're trying to get you exclusive access to a property they think is a good fit for you.

#10- Enter negotiations

Once you have found right property with the best features in your price point and the neighborhood you want, it's time to submit a purchase contract to the homeowner.

At this point, different scenarios occur. Again, having the right real estate agent who knows how to handle different problems and negotiate smart matters. While the final contract terms are up to you, a real estate agent will counsel you if there are multiple offers on the property, if the sellers respond with a counter offer, and where you have some wiggle room in the contract. They know what’s a reasonable request and where to draw the line.

#11- Enter the pending phase

Once you and the current homeowner agree on a contract– includes the purchase price, the earnest money deposit, and the contingencies–the home is now a pending transaction. Escrow has been started. Multiple wheels will be in motion during this phase. We recommend reading how to prevent your house from falling out of contract.

If you need to secure financing, you will go through the process of obtaining home loan from your chosen lender. They likely will order an appraisal. Should the appraisal come back for less than the purchase agreement, you have options. Your real estate agent will discuss these with you.

Most purchase contracts contain a contingency for home inspection. You will need to hire a home inspector and have them visit the property in question. If there is anything of concern in the report, talk with your real estate agent and negotiate changes to the contract with the seller. These could be credits for major repairs or asking the homeowner to make repairs before closing.

#12- Final walk-through

Before the home purchase closes, you have the option to do a final walk-through. This is an important step you should do with your real estate agent. It's your final opportunity to ensure everything in the home is in working order. Try everything: all the faucets, the HVAC system, the garage door, the windows. If your appraisal or home inspection brought up repairs for the seller to do, bring the report with you. Make sure the repairs were done.

#13- Close on the home

When all the contingencies have been lifted and the final walk-through is it success, it is time to close on the property.

During closing you will pay the closing costs and escrow fees. Before the meeting, you should have received your HUD-1 Settlement Statement which shows line-by-line every expense and who is paying what at closing. This should tell your financial responsibilities when you sit down at the table.

The closing meeting includes a lot of paperwork, like signing legal rights to the property, official disclosures and transferring the home deed. Review all the paperwork. Ask for clarification for any paperwork or clauses you do not understand.

By the end of the meeting, the keys will be handed over and you’ll be the proud owner of a new home.

Buying residential property

As you can see, our earlier statement that buying a home can take months or longer is no exaggeration.

It's our job as real estate agents to make sure everything goes smoothly and you find the best home for your needs. At the Chicotsky Real Estate Group, we like to use our Fort Worth market expertise to make dreams happen. Our mission to service our residential buyers through education, due diligence, and outstanding support at every step of the journey.