Not everyone enjoys mowing the lawn or maintaining a garden. Shoveling snow is a task few people enjoy. Some people would like a pool, but not all the maintenance that goes with it. For this reason and more, owning a single-family home isn't for everyone. Still, the financial advantages of home ownership are attractive.

Enter alternative housing options. Apartment-style living through Condominiums marries the advantages of home ownership. Condominiums, or condos, build real estate equity while reducing the owner’s maintenance responsibilities. Keeping the grass trimmed and pool clean becomes someone else’s job. Large communities may have perks not associated with a single-family home: a full-time property manager, concierge, fitness center, playgrounds, business centers, etc.

Interested in condominium lifestyle? Learn about:

- The difference between condominiums and apartments

- The advantages of condominium living

- How purchasing a condo is different from a detached single-family property

- HOA or condo associations

- Steps to buying a condominium

- Additional considerations

We cover multi-family buildings with fewer than four units (duplexes, triplexes, quadplexes) and town homes in a separate article.

How is a condominium different from an apartment?

Sometimes new buyers are confused about the difference between condominium and apartment. After all, don't both living quarters essentially share walls and roofs with other people? Why the different terms?

Stylistically, apartments and condominiums are the same. The difference is in the ownership. An apartment refers to a rental property owned and usually managed by a property management company. This apartment is located in a residential building, complex, or community. The tenants in the complex follow the same guidelines for renting and answer to the same owner.

Condominiums will have units in a communal living situation that are privately owned. That is, each owner is a different person. The common areas are collectively owned by all the residents. The owner of the condo unit can rent their property if allowed by their association, but the tenant answers direct to the owner.

Who owns condominiums?

An erroneous perception is that condominium units are exclusive for senior housing. Yes, condos are a popular housing style for the older generations and many 55-plus communities use a multi-unit construction style. Outside of these specially designated communities, anyone can own a condominium.

A 2017 study of home sellers by the National Association of Realtors® (NAR) did show a greater portion of owners were aged over 60. Eight percent were sold by home sellers age 62 to 70 and seven percent by those 71 and older. However, the study does reveal condominiums are owned by people of all ages and lifestyles. It found nine percent of apartments and condominium-style homes were sold by owners age 36 and younger. In fact, when you look at the numbers across the NAR study’s age brackets, you see near-even distribution of condo sellers.

Downtown Fort Worth’s 2016 State of Downtown report shows 23.6 percent of condominium and town home residents aged under 40. That’s almost 1 in 4 owners.

Why is the condo lifestyle appealing across age demographics?

The condominium advantage

#1- Access to ownership

Median housing prices continue to rise throughout the nation. Fort Worth is no exception. High demand for single-family homes drives up median sale prices. As more millennials enter the housing market for the first time, demand for affordable housing impacts inventory for starter homes. The cycle continues: low inventory and high demand increases prices, meaning some first-time buyers find themselves priced out of their first home.

Traditionally, condominiums are less expensive than buying a detached single-family home. The NAR reported the median housing prices in January 2018 as $241,700 while the median condo price was $231,600. This small difference can be monumental for first-time buyers.

The price difference between single-family homes and condos changes when you start looking at local markets. According to the Texas Condominium Sales Report 2018, the median price of a Texas condo in the first six months of 2018 was $185,000. Dallas-Fort Worth condos averaged $194 per sqft during the same time.

For some potential buyers, owning a condominium is their path to home ownership. It's how they are able to live in the neighborhoods they want without breaking the bank for a residential property. The lower price point equals a lower down payment and lower monthly payment. As long as they make a smart purchase, they still build equity and gain some appreciation.

#2- Affordable second home

Other condo buyers seek a second home for a variety of reasons. They want to escape the northern winters, a place to stay when they visit their family, or an investment property for their portfolio. Condominiums have a reputation as being popular in vacation destinations for this reason. People own a slice of real estate close to their favorite destinations but avoid the hassle of the upkeep. The lower price point makes it easier to find a property in their ideal market without dipping too deep into savings.

#3- Property taxes

Condo owners are able to take advantage of the same homeowner tax deductions on their mortgage payments as single-family homeowners. Note: owners still to pay your property taxes on the unit, and association fees are not tax-deductible.

#4- Reduced maintenance

Few properties are truly maintenance-free. In the case of a condo, pushing the lawn mower around the yard on a steamy July day becomes someone else’s responsibility. Landscaping, exterior touch-ups, cleaning the gutters, and more shift to someone else's plate. Imagine a life where you can relax poolside instead of raking lawn trimmings.

#5- A real community

Since condo communities are often multi-units situated in high-rise towers or complexes, you will be much closer to your neighbors. People will run into each other in the common areas. You'll start talking to the residents while at the pool or walking the grounds. Chances are, you'll build more relationships with the people you're living with than if you lived in a detached suburb.

#6- Location, location

Condominiums’ smaller footprint means they fit more people into a space than a single-family home. This makes them ideal to be closer to high-demand areas like the downtown core. Translation: condos tend to be closer to amenities. Shopping, entertainment, retail, and work are closer to condo residents than to people choosing to live in the suburbs. Many condo owners have shorter commutes than homeowners for this reason.

#7- Those amenities

To attract owners, condominium complexes often add amenities to their common areas. Amenities we’ve seen included in condo complexes include:

- Swimming pool

- Fitness Center

- Playgrounds

- Concierge Services

- Sauna and/or steam rooms

- Meeting rooms or business centers

- Walking trails

- Wine cellars

- Social spaces

- Dog parks

No two condos have the same amenities available. Do keep in mind there is a correlation between available amenities and condo association fees.

Why condominiums are different from single-family properties

Condos are multi-unit properties simply divided into individual units. While you alone own your individual unit, naturally you will have shared spaces. At a basic level, this includes walkways, parking lots, stairwells, and elevators. It will include the extra complex amenities.

To manage these shared spaces, condominium complexes have associations, referred to as a condo association or homeowners association (HOA).

About Condo/ Homeowner’s Associations

In addition to a monthly mortgage, you will pay a monthly fee to your condo association. This association levies the fees, stipulates the complex’s rules and regulations, and enforces the code. It sets the budget and makes sure the community can afford its shared amenities. Their main goal is to create a sense of community among residents.

Before you buy into the complex, familiarize yourself with a condo association’s regulations and fees. Every HOA has different rules and regulations. Some will dictate what kind of blinds you can have in your unit or how many cars are parked in front of your unit. Don't buy into a condominium to find you can't live with the association's rules.

When you hear about condo complexes being in trouble, it often boils down to poor management. Condo associations typically are run by an elected board of condo owners. (Typical structure is summarized here.) Most board officers are well-meaning, but their participation doesn’t mean all the elected owners are qualified at their role. One poor decision on how to spend funds leaves the future residents on the financial hook for essential repairs.

Every condominium association has a reserve fund. This fund is intended to cover major repairs, like a tree falling on a roof or flooding in the storage unit. If the reserve fund lacks enough capital to cover a major repair, the association can levy a “special assessment” owners are required to pay.

Think of a condo complex as a business venture. Learn how the place is managed and run. Study its financial stability. Eventually you will sell the condo unit. It’s more challenging to find buyers if your condo association is insolvent, has a low reserve fund, or high delinquency rate on dues payment.

Condominium insurance

Another difference is in your owner’s insurance. Condo complexes carry a master insurance policy, but these vary widely. Carefully review the complex’s insurance policy to make sure it has adequate coverage. You may be surprised at what the policy will and won’t cover.

Individual condo insurance covers the gaps between what the master policy covers and to protect the assets inside your unit. It should cover damage, theft, and liability claims.

Buying a condominium

The decision to buy a condominium mirrors any home purchase decision, but with some additional steps due to the nature of a condo unit.

#1- Secure pre-approval

Unless you plan to buy all-cash, do speak with lenders about their requirements for securing financing on a condo unit. Lenders often have stricter requirements for condominium financing because the market is seen as more risky. Expect a higher down payment requirement, more paperwork validating the complex’s good management, and guidelines on living in the unit.

Gather the documents you’ll need to get pre-approval. Know what the lenders will want to award the loan and how much you’re able to afford.

#2- Research the market

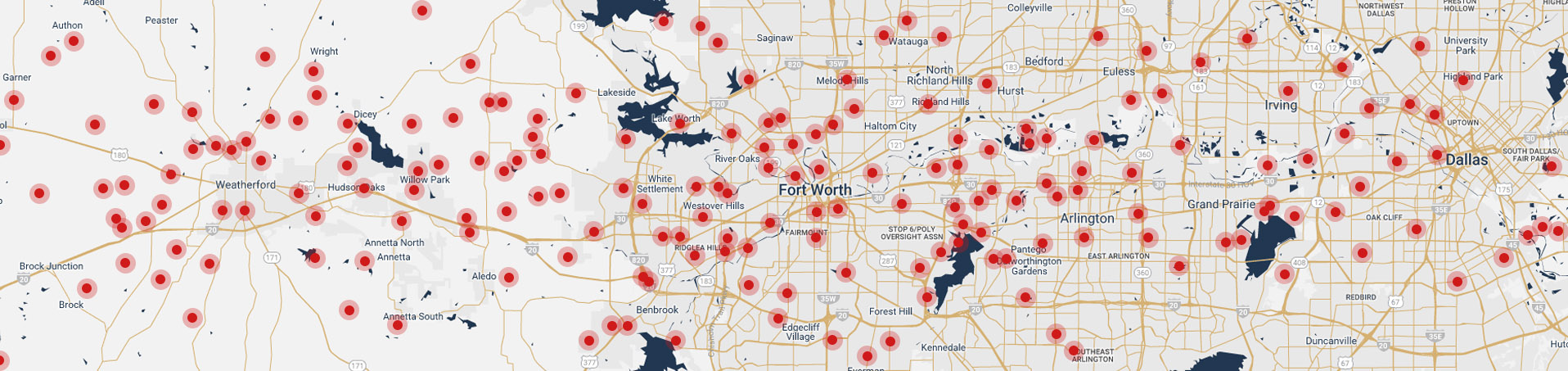

Speak with a real estate professional with experience in condominium transactions. Learn the current market trends for complexes. Downtown Fort Worth’s condo market will be different from the activity and pricing in Ridglea or North Fort Worth.

#3- Factor condominium association fees in your budget

How much condo properties charge for the common area fees varies widely. There is no standard. For each condo unit under consideration, look at the association fee. Keep the payment inside your total monthly budget.

#4- Conduct your due diligence

When you have a unit of high interest, remember you’re not just buying property. You’re purchasing a slice of a greater community. Talk to the community manager or the HOA president. You’ll be interacting with these people, so establishing a good rapport is essential to a good experience. Someone with a standoff personality could be a bad sign.

Ask to see documents that demonstrate how the condominium is governed. Study the regulations. Look at the past meeting minutes to see what residents complain about the most. Most importantly, find a way to get your hands on the budget. How much does the association have in reserve? How many owners don’t pay their dues? Has the association charged special assessments in the past? Has the association eliminated certain amenities as a way of saving money? These send red flags that this particular unit could be a risky investment.

#5- Contract offer

In your condo purchase agreement, include relevant contingencies like securing financing and unit inspections. Add these contingencies as part of due diligence:

- Review of condominium bylaws and restrictions

- Current and prior year condominium association budgets and year-to-date expenditures

- Balance sheet

- Minutes from past HOA meetings

Sit with a professional experienced in condo associations when reviewing these documents. You want a second opinion to tell you if the finances and bylaws show the complex is financially stable. These could be a real estate attorney with condo experience or a certified professional accountant.

Buying a condominium as an investment

Considering purchasing a condominium and renting it as an investment property? Owning a condo is a way to source extra income for the long-term. Owning a whole building could net positive cash flow if the financials behind your deal are solid.

The purchasing steps above apply to you. As an investor, there are three additional points needing your attention.

#1- Does the complex allow owners to rent their properties? Not all condo associations allow rentals. Some do, but only a percentage of units. You may need to join a wait list.

#2- Are you prepared for maintenance? Like a single-family home rental property, you’ll be the contact for property maintenance. Apartments tend to see more wear-and-tear because tenants are more transient. Expect maintenance to be a regular issue and roll this into your cost.

#3- Who pays condo association fees? Rather than risk the ire of the condo association by the tenant never paying their fees, many owners roll the fees into the rental price.

Additional considerations for condo ownership

#1- Appreciation

Condo units tend to appreciate at a slower rate than single-family properties. This means you’ll gain equity, but not at the same pace. Many real estate experts recommend only buying into a condo complex if you’re thinking long-term. A five-year minimum is a common figure.

#2- Storage

Condo layouts maximize their space, but do tend to skimp a bit on the storage. If the unit will serve as a primary residence over the long haul, you’ll need a plan to store the toys (bikes, kayaks, etc) and seasonal goods (holiday decor, winter gear, etc). Condos typically don’t have attics or garages. New developments sometimes add personal storage space as an extra amenity.

#3- No deduction for condo fees

Unlike your mortgage payment interest, condo association fees are not tax-deductible.

#4- Your porch

Those front stoops and balconies can be grey areas for condo residents. Who really owns them–you or your association? Check the unit and master deed to find out who owns it and who handles its repair.

Fort Worth Condos

A condo is a great way to be close to downtown amenities, like Sundance Square and Bass Performance Hall. Units range from elegant penthouses with city views and private elevators to renovated lofts in historic buildings. An example of this is historic Montgomery Plaza in the West 7th Street neighborhood.

New complex construction has slowed down in recent years, meaning there is some demand for new properties in the market. The Worth Residences is one major project that will offer 115 homes with views of the Museum District and Trinity River.

Want to learn more about condos in Fort Worth? See this helpful condo neighborhood guide featured in Fort Worth magazine sponsored by Briggs Freeman Sotheby’s International. Another list of condo-style residences found in Fort Worth is published here.

The average days-on-market for a Dallas-Fort Worth for a condo was 65 days in 2018. You want a real estate professional you can work with and count on for several months during the condo transaction. An experienced Fort Worth realtor, like at the Chicotsky Real Estate Group, know how to deliver an exceptional condo buying experience. Attention to detail is critical when it comes to buying a condo. Our thoroughness is second-to-none.