Short-term rental properties, also known as vacation rental properties, are gaining more interest from real estate investors thanks to platforms like AirBnB and VRBO. Some buyers consider short-term renting a way to make owning a vacation home more affordable. Others look at it as an income-producing opportunity.

Popularity and a promise of high returns doesn’t necessarily mean a short-term rental investment is right for you. Like every type of real estate venture, short-term rental properties come with risk. Learn what real estate investors need to know about the short-term rental market, owning and running a property rental business, and specifics about managing these properties in Fort Worth.

What to know about the short-term vacation rental market

A short-term rental property is defined as a property rented for typically less than 30 days at a time. Since owners can charge a higher daily rate, the returns could be more than a conventional long-term property. According to one source, Airbnb rentals make more than three times traditional long-term rental properties. Those types of returns are not a guarantee.

Rental platforms like Airbnb and VRBO are the reason for the increased interest in vacation rentals. The vacation rental industry is projected to make $57.669 billion dollars in revenue during 2019. The market growth rate has been 6.9%. The average revenue per user (ARPU) currently amounts to $659.01. The United States accounts for 20% of all vacation rental properties. The majority of these, 70%, are small properties with 1 to 19 units.

Millennials are predicted to spend $1.4 trillion on travel by 2020. These travelers are more likely to choose short-term rentals over hotels. They represent 40% of the travelers booking their rentals online. Note that around 53% of all travel is booked online, so marketing the short-term vacation rental online is important to finding tenants.

In 2018, 45% of investment property buyers purchased a second home to generate income through renting.

Setting up a short-term rental property

If you're interested in this type of real estate investment, it's important to treat it like a business. We advise setting up an official business, as we discussed in this article about rental investment business structure. The right structure protects your investment and financial future.

A short-term rental property typically needs more hands-on management than a rental with a stable tenant. The higher turnover necessitates more frequent in-person check-ins and cleanings. The risk for damage also increases. Investors who choose to create a short-term rental business often hire maintenance and cleaning staff for their properties. Some hire property management firms specializing in short-term rentals.

Another aspect will be finding a short-term rental property in the right location. Since the most likely tenants will be on vacation, proximity to local amenities matters. Safety is another concern. The renters will want to feel secure in the property and the surrounding neighborhood. Check the municipality’s restrictions on short-term rentals; you may be surprised to find a vacation rental property is not allowed in certain choice neighborhoods. An experienced real estate agent partner can be a helpful resource.

Why invest in short-term rentals

#1- Market growth

Vacation travelers are increasingly becoming comfortable with the idea of staying in someone's home rather than a hotel while on vacation. In fact, the short-term vacation industry is predicted to overtake hotels by 2020. The growth is evident in the increased percentage of units owned specifically for short-term rentals in a given city. Currently, Airbnb rentals account for 9 percent of the total lodging units in the 10 largest U.S. markets, claims one source.

Short-term rental properties are viewed as more affordable, especially when being rented for larger groups. Other people enjoy the comforts afforded by these homes, which often give them access to cook their own meals, while staying near the amenities they are seeking to visit. For this reason, the demand for short-term rentals is expected to continue.

#2- Revenue potential

In the right circumstances, property owners charge more for short-term rentals than long-term rentals. This means they can generate more revenue in a year compared to having a long-term tenant. Securing returning short-term renters reduces some of the uncertainty this business model brings. However, just because short-term rentals have the capacity to produce more income doesn't mean they necessarily do, as discussed below.

#3- Portfolio diversification

Operating a short-term property rental investment is another way to diversify and safeguard your investment assets. Diversification is how investors protect themselves from market upswings and downswings.

The revenue from the short-term rentals could help cover the mortgage on the property. This means ownership in this asset class might be a way for first-time real estate investors to enter the business. Since short-term vacation rentals don't have a set look and style, they are an accessible entry point to building a real estate portfolio. Do a simple search on any of the rental marketplaces. You'll see people renting everything from tree houses to single rooms to mountain top chalets.

#4- Tax advantages

Owners of rental properties operated as businesses are able to deduct mortgage interest on the properties and the business expenses, according to the new federal tax law. It's also possible if you are operating the rental as a business to deduct 20% of the net rental income from your income taxes. Do consult with your tax professional on these possible advantages.

#5- Finding renters

Online rental marketplaces have made it easier to advertise and book short-term rental properties. The big name in the business is Airbnb, founded in 2008. It's continuing to grow, even other competitors have entered the market. Other top names in the industry are VRBO, FlipKey, and 2ndAddress. These marketplaces take care of marketing your property to potential renters, help with the booking, and offer additional add-on services to assist with management.

The downside to short-term vacation rentals

As with any real estate investment risk, it's important to weigh both sides of the coin. Consider if you can handle these drawbacks to short-term rental ownership.

#1- Failing to make revenue

While a short term rental property can charge a higher rate to its renters, whether it's able to stay in the black or green depends on factors beyond the owner's control.

First, if you're operating it responsibly as a business, you'll have ownership expenses like paying for relevant licenses and fees. Property maintenance and upkeep come with expenditures, and any capital improvement costs fall to the owner.

If the property is not booked frequently enough, it's not generating revenue. Some markets have on and off-seasons, meaning it may be full through the summer but dormant during winter. The rental owner must float the property while it's not occupied. Long story short, the cash flow is inconsistent.

#2- Tourism vulnerability

The economy is strong and doing well, people are happy, and tourism is up. But when businesses start to struggle and expenses start to rise, the tourism industry feels the bite. People simply travel more when the economy is doing well and less when it’s in a recession.

Local markets are also vulnerable to disasters beyond their control, like flooding or a domestic terrorism event. All Florida tourism took a hit when a record red-tide hit its waters in 2018, even though not all its coastline or cities were impacted.

#3- Increasing fees

The difference rental marketplaces charge management fees at take a bite out of your potential revenue. Hire a professional manager or any other service vendors to help maintain the property, and more fees will be deducted from the rental amount.

#4- Low profitability

While fans of short-term rental properties will claim you can make a profit from the industry, there is a huge caveat. How much profit you stand to make from the rental property is going to depend on the purchase price of the property, what market it is in, and how often it is occupied.

Basic investor common sense is the lower your monthly property mortgage, the more you can profit. So the greater your down payment, or ability to pay all-cash, the better.

We found this fascinating graph by AirDNA using AirBnB data that shows the correlation between housing cost and profitability. Some of the best cities for a high gross profit were Joshua Tree, CA, Savannah, GA, and Nashville, TN. Popular cities like San Diego and Seattle had a much lower return.

Even the study authors do note that these numbers are simply an average of a broader. Gross profit will fluctuate based on the property’s neighborhood. For instance, a property in Hollywood, CA, might be in higher demand, but its purchase price is likely more, too.

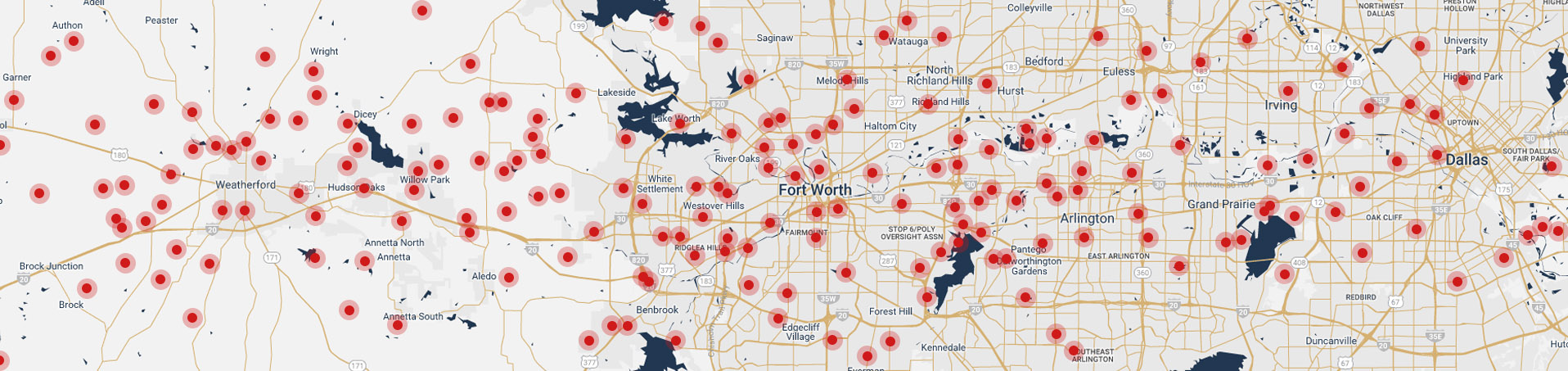

Short-term rentals and Fort Worth

It's important to know if you are interested in owning a short term rental in Fort Worth that these kinds of properties are not allowed in residential areas. Short-term rentals are limited to commercial and industrial areas that blend housing and business. However, they are exempt from Fort Worth’s hotel tax.

Owners are not required to register with the city. This has made it hard to know how many short-term rental properties exist in Fort Worth. But you can see there have been some complaints in area neighborhoods about owners running short-term rental properties.

There has been some movement in the Texas legislature to start regulating short-term rentals in Texas. For now, the latest bill was left pending in the Housing Urban Affairs committee.

More states and cities are taking measures to regulate and enforce measures about short-term rental properties. Smart investors should track the news to know what new legislation and requirements are being considered.

Trends in the short-term rental industry

Smart business owners pay attention to the consumer trends in their industry. It’s clear that having an online presence will be necessary for attracting renters. What else can you do to make sure your rental property meets its investment goals?

#1- Customer expectations

People who book short-term vacation rentals seek something unique and memorable. They're trying to create a vacation that has the potential for social media engagement. They want to brag about their experience by the sharing events and little extras that made it a second-to-none vacation.

These consumers are doing more research about their destinations. They're looking at online photos and reading the reviews. They look for their prospective rentals to have certain amenities, like free Wi-Fi access or activities to entertain their families. Essentially-what bonuses does this rental offer that makes it more special than a hotel?

To attract customers, vacation rental properties need high-quality photography to compete. They want curated photos that make them feel like this rental is the place a person wants to be.

Customers also want their questions answered quickly. Friendliness and speed to respond could make or break a person booking with you or going with a competitor.

#2- Pricing changes

Short term rental property owners used to pay subscription fees to list their properties. This model was popular with VRBO. Now most of the industry has changed to a transaction pricing model. The owners and the travelers pay commission fees on the vacation rental bookings.

#3- New competition

Airbnb continues to be the dominating leader in the short-term vacation rental industry, followed by VRBO. But there's always space for competition, and the vacation rental industry is seeing new platforms coming online to provide alternatives for vacationers. These include platforms like ApartmentJet and Stay Alfred.

How the new players are trying to differentiate their services is by raising the bar on what a short-term rental property offers. There's additional available services, like professional management or short-term rentals designed to meet the needs of specific travelers. Other platforms curating complete experiences and not just where people stay while on vacation.

#4- New regulations

Local municipalities are responding to residential complaints about short term rental properties and the potential to make money. In recent years, there's been an increased focus on making sure short term rental owners and operators are paying the required taxes and staying in compliance with their licensing. Some property owners were unaware that they had to pay taxes on their rental property and didn't know how to comply with local legislation.

Some marketplaces help their short term rental owners collect and pay their taxes to the authorities.

Other municipalities are creating new regulations and policies about how short-term rentals can operate. These regulations, like those in Fort Worth, sometimes limit where a short-term rental property can be and how many days they are allowed to rent.

#5- New service providers

Where there is an opportunity, there will be a business. Now property management agencies are catering to the short-term vacation rental market. Some vendors act as consultancies, working from start to finish to help investors set up a successful vacation rental business. These consultancies help find the ideal property, stage it for optimum occupancy, and manage the rental process.

New technology tools help with property management. These innovations improve how owners communicate with guests and schedule the bookings. There's also a move toward smart home systems specifically designed for the short-term industry.

Another new service pairs the rental property with vacation experiences. Airbnb launched its Experiences section in 2018. This section offers services based on the area around the accommodations. It's all part of its goal to deliver superior customer service to Airbnb guests. Skift reports that 67% of United States Airbnb users booked an Experience on the platform in 2018.

Getting started with short-term rentals in Fort Worth

How do you take the leap to get into the short term rental industry in Fort Worth? Your basic steps would be:

- Make sure you have the necessary funding to purchase a second property

- Create a business entity to protect yourself from liability

- Research the requirements of the rental marketplaces to decide which one will work best for you

- Read the Fort Worth City code about where short term rental properties are allowed and locate the relevant zones, or:

- Partner with a local real estate agent familiar with Fort Worth’s zoning laws and working with real estate investors. Agents with particular experience finding short-term vacation rental properties will be a true asset to getting started.

- Have a system in place for managing the property.

At Chicotsky Real Estate Group, we have worked with real estate investors for years. We understand how important it is to make the right purchase in order to create a profitable and thriving portfolio. Let our experience be your guide.