You received your first offer from a buyer. Congratulations! Now starts the business of selling: negotiating the deal.

It's rare that the first offer comes in magically perfect. We're not saying it doesn't happen, just that it is unusual. Barbara Corcoran, known as one of the Sharks on ABC's Shark Tank, prefers business deals to have a little negotiation. She believes when the first deal is accepted, it leaves the sellers wondering if they could have gotten more and the buyers wondering if they could have offered less.

When you see the offer for the first time, be prepared to be unsatisfied. It's unlikely to have all the bells and whistles you are looking for. A real estate agent with polished negotiation skills and industry experience is how to bring the offer closer in line with your selling goals.

Getting ready for your negotiation

Sellers and buyers are naturally at odds with each other. As a seller, you want the list price. You'd even settle for more than list price. As real estate agents, we understand that.

Buyers want to get the home for as little money as possible. Negotiation is necessary to bridge the gap. Make the gap smaller by being prepared ahead of time in these four ways.

#1- Be realistic about list price

Home sellers are unlikely to get 100 percent of their list price. If they do, they probably made some sort of concession that isn't immediately evident. However, according to the 2018 Profile of Home Buyers and Sellers published by the National Association of Realtors (NAR), nationally sellers received 99 percent of their list price. Typically the national average is closer to 97-98 percent. In Fort Worth, sellers typically net between 2-12 percent of list price, factoring in neighborhood, home condition, and price point.

Go into the negotiation knowing you probably won't receive 100 percent of your list price. Figure out what you want your bare minimum list price, but do consider more than the dollar signs. There are other areas for concessions that might matter more to you than what the buyer’s offer price. An example of this is if you need to get out quick due to an unexpected life change. It may be more important to you to sell quickly than to sell for top dollar. That changes your negotiation strategy.

#2-Stack the odds in your favor before the offer

Your chances of receiving closer to 100 percent of the list price increase when you stay in control of the sale from the moment the buyers walk through the door. The easiest way to do this is with a home inspection.

A home inspection reveals any significant defects in your property before you put it on the market. It’s your choice to repair the defects or to adjust the list price accordingly. When you decide to make accommodations through the list price, you give your listing agent a tool to use with the buyer’s representative. Your agent shows you’ve already compensated in the pricing by this amount for this particular issue. It gives the buyer less wiggle room.

Buyers like to get hung up over the smallest things, like squeaky closet doors or flickering lights. You’d be surprised what kind of concessions buyers ask for over something fixed with WD-40, basic tools, and elbow grease. Take the small things off the table by fixing them before you list.

Another way to stack the deck is to get the third-party appraisal before the selling process. Show the buyers the market value of the property and why you priced it the way you did. This is useful if you’ve recently renovated or have some unique features.

Finally, if you think there may be concerns about some features of the home, adding a home warranty as a perk can overcome price objections and make your property more marketable.

#3- Be educated

Nothing shuts buyers down like an educated seller. Before listing, sit down with your listing real estate agent and get familiar with your local neighborhood market dynamics. Know your available inventory, your market outlooks, and have some idea about the current interest rates.

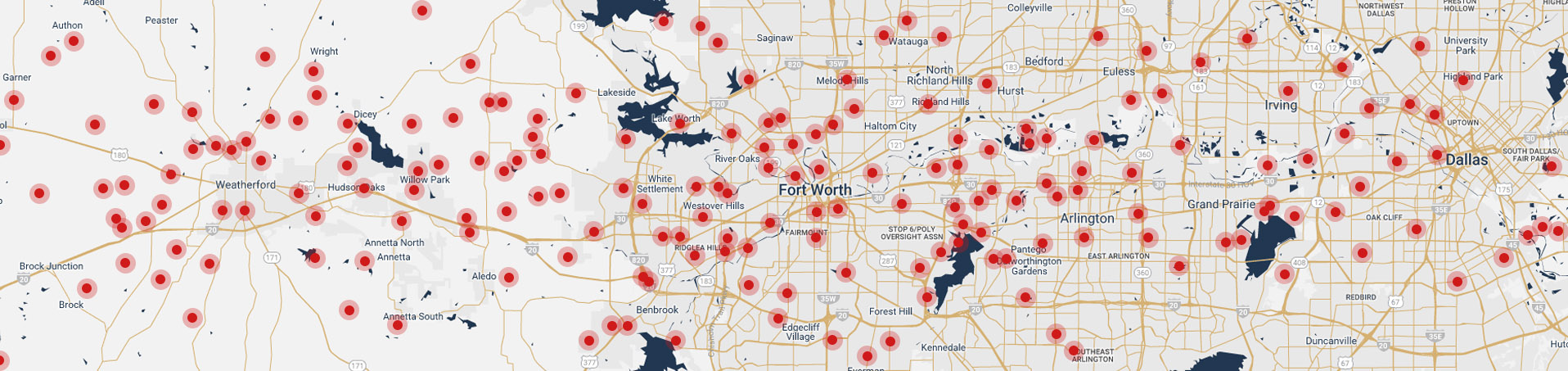

Most importantly, know the supply and demand. A buyer's market is when there are more homes than buyers searching. A seller's market is the reverse: fewer properties and more buyers increasing demand for housing. Texas A&M Real Estate Center reports show greater Fort Worth’s housing activity back to 2011, and you can see current conditions are in the seller’s favor.

Markets do vary neighborhood to neighborhood, so talk to your agent. Work together on a strategy to handle the negotiation. They have an idea of what to expect and how to approach potential offers. Trust in your real estate agent. You hired them for their expertise.

#4- Be willing to walk away

No one said you had to take the first offer. Yes, conventional wisdom says that the first offer is usually the best offer. But if you truly cannot come to terms with the buyer's offer and you are unable to negotiate, there's no reason you cannot walk away and wait. It's a powerful statement when your listing agent tells the buyer’s representative you are ready to walk away and you actually mean it.

First steps after receiving an offer

You've done all your preparation and now your listing agent brings the first offer for your review. Go through all the details and ask as many questions as possible. Here's what to study:

- Price

- Earnest money deposit

- Down payment

- Terms

- Estimated closing date

- Contingencies

- Response time

Other than the response time, which is when the buyers would like to hear from you or receive a counter-offer, everything else has space to move around.

Contingencies and terms can separate what looks like a good offer from a great offer, or they can sink the deal. Some contingency clauses to review:

- Is the purchase of this home contingent on the sale of another home? This weakens the offer. It means that the sale of your house depends on the sale of another house with a different set of sellers and buyers. A home sale contingency creates a domino effect that puts your sale in jeopardy.

- Is the buyer’s purchase contingent on getting financing? If they're already pre-approved for the loan amount, there's probably nothing to worry about. It just may extend the time of the proposed closing date.

- When do the buyers wish to close? This is important for you to see if you will have enough time to move out. You do have some options here which we will discuss later on.

- Are they asking for help with closing costs? We’ll cover what to do here further down the article.

- Disclosures and inspections. A pretty standard contingency clause is that the buyers will only purchase a home if they approve of a professional home inspection. The buyers usually have a few weeks to do these inspections.

At this point, you’re deciding if the contingency and terms are reasonable or if it impacts the value of their offer.

Steps after reviewing the offer

At this point, you have three basic choices:

- Accept the offer as-is

- Reject the offer outright

- Reject the offer and counter with your own

When you follow steps two or three, the buyers have every right to walk away from the deal. They don't have to agree to your counter or respond with another counter. Normally buyers and sellers go back and forth.

Let’s start with where to make counters more favorable to what you want from the deal.

Countering the contingencies

You have some different options depending on the contingency you are contesting. You have the option of simply crossing out the contingency. This indicates to the buyer this is not something you are willing to negotiate on. You can also limit contingencies by time or by dollar amount.

Earnest money deposit

This deposit shows how serious buyers are about purchasing your home. The deposit is made after both of you have signed a purchase agreement and decide to move forward. Typical EMDs range between 1-3 percent of the purchase price. The higher the deposit amount, the more committed the buyer likely is to follow through on purchasing your home. However, if you're working with first-time home buyers, this amount might be a little smaller. The buyers are likely saving their existing funds for closing costs and the down payment.

Asking for a higher deposit helps give you the upper hand in negotiations. If the buyers walk away from the deal, they risk losing their deposit if certain conditions are not met.

Closing price

The purchase price is usually the top concern for buyers and sellers. How much to wiggle here really depends on you and the other terms in your counteroffer. Some negotiating strategies real estate agents use here:

- Counter at the list price. The buyers expect some back-and-forth negotiation on the list price. Usually, their initial offer is lower. It's also probably lower than what they might be willing to pay for your property. At this point, most sellers come off their list price slightly as they don’t want to seem unwilling to negotiate. Let’s assume you fairly priced your property according to your market research. You intend to get the money you deserve. Why not counter with the list price?

Some buyers will balk at this maneuver. They may walk away. These likely are buyers you don’t want to work with anyway: those seeking bargains and making lowball offers.

If you don’t like this strategy, an alternative is to drop your list price just $1000. It shows you’re tough, but not inflexible.

- Counter higher than list price. This works best if you’re accommodating one of their contingencies, like paying for some of the buyer’s closing costs. It’s also a risky strategy, as it may turn them away.

Countering terms

This area has a lot of flexibility. Most buyers are seeking a new loan and plan to make their down payment in cash. Sometimes they ask the sellers to carry part of the financing, like a second or third mortgage for a portion of the down payment. You can negotiate the loan length or the interest rate.

Other terms include what’s included in the property, like furnishings or appliances. A fully-furnished or partially-furnished property would note what’s included in the home sale. We’ve seen terms for seller purchasing a home warranty and to have floors professionally cleaned.

Let’s break down some other terms common for countering:

#1- Counter the occupancy

Do you need to move out later than when the buyers want to close? Counter with a different closing date or counter with a leaseback. This allows you to close on time but stay in the home for a certain amount of days.

Essentially, you lease your home back from its new owner for a set rate. This option allows more time to prepare and execute the move. Not all buyers might agree to this. They see it as a risk that you could damage the property after closing or you may not leave at all.

#2- Pay buyer closing costs

This kind of term is becoming more common in real estate transactions. Closing costs amount up to 3 percent of the purchase price. Buyers feel strapped with paying for a down payment and moving expenses, making closing seems like more fees out of their pocket. Especially for first-time homebuyers, some can't afford to close the deal without assistance on the closing costs.

Some loan programs allow home buyers to wrap up some closing costs into their home loan. If not, sometimes the buyer can afford to borrow a little more to offset the cost of you paying for their closing costs.

When a buyer brings an offer asking you to pay the closing costs, counter with an increased purchase price even if it means going above your list price. Buyers don't realize sometimes that in paying their closing costs, you lower your net gains from the sale. Raising your list price to compensate for those extra few thousand dollars shouldn't be a big deal.

The only catch in taking this route is making sure the home appraisal supports the increased purchase price. If the buyer's lender says the home overpriced, they won't finance the deal.

Buyer home sale contingency

Let's say one contingency is a buyer home sale contingency. One approach is to craft a contingency that allows you to keep your property on the market and soliciting second offers in case their home sale falls through. This contingency essentially says that their offer will remain on the table until a second and better offer comes along. It's kind of a win-win scenario for you. Either you get a better deal or eventually, you end up selling your home to this potential buyer.

Other seller negotiation tactics

#1- Flat-out rejection

Sometimes the best counter is a hard “no.” It can be a bit extreme, and you risk having the buyer walk away, but if they're really interested in the property a rejection may not turn them off. Instead, it indicates you know exactly what your property is worth and you are willing to wait. You're not willing to negotiate unless they come to the table seriously. This fear of missing out scares some buyers because they know a better offer could come along at any time.

A flat-out rejection also dissuades buyers fishing for bargains.

#2- Creating a bidding war

This strategy only works effectively when your property first comes on the market. Make the property available to be shown and schedule an open house for a few days after it gets on the market. However, do not entertain any buyer offers until after the open house. Use it as a marketing strategy with your listing agent.

This method aims to create a sense of competition. You may end up only getting one offer, but that buyer doesn't know that. If you do get multiple offers using this scenario, you can go back to your best bidders and start a bidding war.

#3- Leveraging multiple offers

As a seller, this is your dream scenario. Instantly, your buyers are in a position of weakness because you have them competing off of each other to win the property.

The first step is to let all the parties know you have multiple offers. Ask for their best and final.

When all the final offers have rolled in, compare and contrast the terms of the deal. Select the right contract or pick the one you think will be most willing to negotiate to your terms.

Remember when looking at the different contracts to take into account the different terms and contingencies. Someone who gives you a slightly lower purchase price might have contingencies that are more favorable, like a higher earnest money deposit or not asking for closing cost assistance.

Put an expiration date on the counter

Remember once you create a counter-offer with the buyer, you're in a legally-binding negotiation. You cannot accept a better offer if it comes along. That's why it's important to put an expiration date on your counteroffer. This compels the buyer to make a decision so you get your home under contract or you can move on. You don't want the deadline so short the buyers are turned off, but making it slightly shorter than the standard default time frame is not unheard of.

Accepting the offer

Once you have a buyer offer that you feel satisfied with all the contingencies, terms, and purchase price, you can agree to accept the buyer’s offer. Remember the offer is not official until you sign the purchase agreement.

How to win the negotiation

Let's recap. To win the negotiation as a seller, you've got to stand your ground when it comes to your most important financial asset. Understand you probably won't be 100 percent happy with the agreement, but you never settle for less than what your house is worth. Your listing agent will help you approach the negotiation process well-educated and know where your line stands. You can always walk away and wait for more buyers.

Looking for someone to be on your side when you list your home? The Chicotsky Real Estate Group are expert negotiators with a passion for representing sellers to the fullest extent possible. We are committed to helping you gain top value from your home and know how to leverage its best features for real results.