The real estate market during the last 18 months has been unprecedented. In the initial days of the public health crisis, the conversation centered around an expected real estate market crash. That didn't happen. Instead, the market experienced an acceleration, moving towards a seller's market.

Home sellers have appreciated the current market situation, as they command top value for their homes and sell quickly. The flip side is the near-record low inventory makes it harder for some buyers to secure a home. Buyers experience frustration as they lose time after time to multiple offer situations, and the home hunting process drags on.

Real estate is cyclical. The current market conditions won't last forever. Inventory will rise, listing prices will stabilize, and the market will come back into a more balanced state. When exactly will this happen? Let's examine some of the factors controlling the real estate market and when we could see a more favorable real estate market for the home buyer.

What happened to create the current real estate market?

For a few basic reasons, the 2020-2021 real estate market did not experience a recession like 2007 and 2008.

#1-Unsafe Lending Practices Fed the Recession

The Great Recession was more related to mortgage lenders extending financing beyond what borrowers could afford. As a result, homeowners found themselves underwater on their mortgages when the market crashed, compounding the economic problems. Since that time, legislators have enacted different regulations to protect borrowers and mortgage lenders from overextending themselves on a home loan.

#2- Constrained Housing Supply

That same recession impacted new home construction. As distressed properties flooded the market, fewer people could afford to buy homes, leading to a stall in new housing starts. It has taken a long time for residential construction to pick up the pace. The result is a lag in available inventory insufficient to meet today's demands.

#3- Owners stayed in place

To have a healthy real estate market, you need a blend of existing homes coming onto the market and new construction properties. During the pandemic, the existing housing supply dropped because more homeowners stayed in place. The lack of a movement has persisted.

Some homeowners who would normally consider selling are staying put because they are worried they won't find another property to buy. It's compounding the low inventory situation.

#4- Demand did not decline

If you've been following the real estate market at all, you know that the millennial generation has been a purchasing driver. This group of homebuyers put off purchasing new homes mostly because of economic reasons. As millennials achieved a better financial position, they were starting to buy first and even second homes.

The increase in first-time homebuyers puts pressure on the lower end of the housing market, which had a constrained supply because home builders weren't necessarily building these kinds of housing. The lower price points saw higher demand and declining inventory. Demand on lower brackets trickles upward through the different pricing brackets.

Compound that with the pandemic. Already declining inventory declines further as this generation has the purchasing power and financial security to buy. Plus, real estate investors waiting for an opportunity saw the pandemic as a chance to secure deals. Persisting low mortgage rates throughout 2020 and into 2021 encouraged buyers at every bracket to continue their housing search, ratcheting up demand.

#5- Lifestyle preferences shifted

When the stay-at-home restrictions forced people to work and live within their homes, homeowners' priorities shifted. There was a need for extra space to provide access to the outdoors and families trying to juggle work and at-home education. People began to question why they lived in an expensive and dense urban center to be close to work when they were no longer going into work.

The result was homeowners decided to exit these crowded metropolitan areas for more affordable and spacious properties found in mid-sized cities, suburbs, and rural areas. Some turned their vacation homes into their primary residences.

#6-Historic Low Interest Rates

Mortgage rates for 30-year fixed loans and other financing terms persisted at near or historic low rates, encouraging homebuyers to take advantage of the cost savings. They felt the pressure to save thousands over the long run by buying now versus waiting for mortgage rates to rise as the market comes into balance.

What was the result on the real estate market?

The combination of low inventory, lagging new construction, high buyer demand, the escape from urban centers, and low mortgage rates worked together to create this seller's market.

A seller's market is when there are more buyers than homes available for sale. The result is that buyers compete for fewer properties, resulting in multiple potential offers and increasing median sale prices. Sellers often see their homes go under contract within days or weeks versus waiting months.

In this case, the seller's market conditions were more extreme than what we would normally expect. According to a survey from the National Association of Home Builders, 66% of buyers actively searching for a home in the second quarter of 2021 say they have spent three months looking for a home without success.

The lower price points homes experienced the most competition amongst buyers. It was not unheard of for homes to have ten or more multiple offers within the first days of listing on the market. However, homes at different price points, including what we consider the luxury market, are seeing high buyer demand and multiple-offer situations.

Competition for homes has been so fierce that many buyers add extra incentives to woo the seller to select their offer. These ranges from all-cash deals, coming in well above list price, short close, and more unusual incentives such as NBA tickets or vacations. Properties are going under contract within days.

With all the demand and buyers extending above list price offers, median home prices have trended upward. The result is some buyers are being priced out of the current homes available on the market or are concerned about overextending themselves financially to become homeowners.

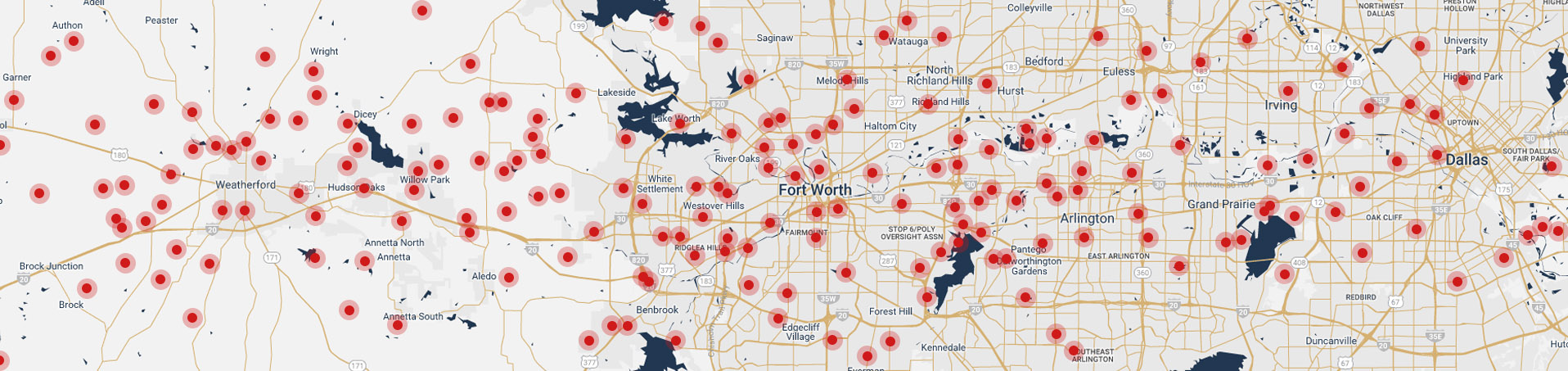

In Fort Worth specifically, the available housing inventory reached 0.9 months. The average days on the market in July 2021 was 19. This tells us that there are still more buyers than homes available for sale. July's median sales price was $302,750, which was 22% more than July 2020.

What will it take for the market to come into balance?

We are now nine months into 2021 and still seeing unprecedented demand for housing in Fort Worth. What needs to be done for the market to swing towards the buyers?

First, we need to recognize that it will take time for the market to move closer to what we consider a balanced market. In Texas, a balanced market is considered to be about 6.5 months of inventory. Given that inventory is hovering at less than a month, we have quite a ways to go to reach that figure.

The low inventory is the greatest challenge in the Fort Worth and Greater Texas housing market. How can we get housing inventory to increase?

#1- Get people moving

Homeowners have been staying in place either because a) they fear they can't find or afford another home, or b) because they no longer see the need to move since their work is now remote for the foreseeable future. Around 43% of homeowners had plans to sell their homes in 2020 or 2021, but around 65% of these decided either to delay selling their home or to not sell it all together. Only 10% of homeowners opted to sell their home as they planned.

We need to free up some existing housing inventory. Current homeowners need to feel more confident about listing their homes. When more existing inventory comes onto the market, it will help cool rising home prices and ease buyer competition.

#2- Higher mortgage rates

The persistently low mortgage rates will continue encouraging people to buy. The Federal Reserve has been keeping its rates low to stimulate the economy throughout the healthcare crisis. While the Federal Reserve rate doesn't directly impact mortgage rates, there is some correlation. If the Federal Reserve raises its rates, we can expect mortgage rates will rise in time.

Currently, median mortgage rates inside Texas remain below last year's levels. According to the Real Estate Center at Texas A&M University, "The median mortgage rate within Texas increased in April 2021 to 3.0 and 3.2 percent for GSE and non-GSE loans."

#3- New construction properties

Housing construction slowed after the recession, but it was picking back up. In fact, the Dallas-Fort Worth area was experiencing a construction boom. New permit starts data from the Real Estate Center showed we were one of the fastest-growing areas.

Still, the construction boom was not generating enough new housing units to meet market demands. Now construction is constrained by supply chain challenges and the rising price of the raw materials essential to building. It's also compounded by the labor shortages and finding qualified workers and subcontractors. Texas housing starts decreased by 6.1% as lumber prices rose. Single-family private construction also declined 8.7%.

It's going to be important to find skilled laborers and easing some of the supply chain challenges to increase new construction. New construction homes are currently in high demand and have low inventory, with buyers waiting months for builders to start on their homes.

When will the market shift towards buyers happen?

No one can put a precise date and time on when the real estate market will start to swing back towards the buyers. It is still highly likely current real estate conditions will favor the sellers throughout the remainder of 2021 and probably well into 2022. However, as the months progress, we expect to see a gradual shift away from these extremely competitive home-buying conditions.

As consumer confidence rises and we overcome the public health challenges, people are more willing to go back to work and start commuting again. This will change what people want from their housing. People will feel confident about moving again, which brings existing homes back onto the market. We can expect that mortgage rates will start to rise, which may help temper some buying activity.

What we need to look for in anticipating the move back towards a more balanced real estate market are the following factors:

- A month-to-month and year-over-year increase in housing inventory

- A month-to-month and year-over-year increase in new listings

- The days on the market should start increasing

- The month's supply of inventory will also start to rise

these trends persist over several months in a row, we are starting to move back towards a market more favorable for the home buyer.

As of July 2021, Fort Worth saw new listings rise for the second consecutive month. This is still not enough to meet current buyer demand, but it is a start.

Your real estate agent will be your best resource as a home buyer. Ask them if they are starting to see homes receive fewer multiple offers. This is another sign that the market is beginning to correct.

When it comes to Chicotsky Real Estate Group, we are committed to being your best resource for Fort Worth real estate. As we navigate through the current real estate market in the months ahead, please feel free to contact us about any of your home buying or home selling questions.