Are you considering buying a vacation home? Purchasing a property in a location you love to visit has its advantages. Not only do you have a place to relax, but you can personalize the property to suit your tastes and improve your vacation time. Owning a vacation property lets you select when and where you want to be based on your schedule.

For all the upsides of owning a vacation home, it's a decision to be made carefully. Purchasing for the right reasons can help diversify your assets, potentially create an income stream, and be part of a strategy for growing your wealth. Let's break down the ins and outs of vacation homeownership and gain perspective about the vacation home buying process.

The benefits of owning a vacation home

A vacation home is essentially a real estate investment, even if it's just a second home for personal use. Owning a vacation home can essentially be part of the strategy to grow your wealth and diversify your assets for retirement. Whatever money you invest into the property, you should expect to get back and then some when it's time to sell.

Real estate values have a greater chance of appreciating in popular vacation areas, like along beachfront destinations or near ski resorts.

Why would someone choose to own a second home in a vacation destination rather than long-term rent? It can be a way to save money on vacations, especially if you buy a vacation home where you tend to spend a lot of time on vacation. You always have a place to stay and won't need to pay the higher cost of a short-term or long-term rental.

Owning your vacation home enables you to enjoy extended vacations. Why spend $300-$500 a night at the resort but only stay a week or so? When it's your vacation home, you go for as long as you want when you want–no juggling bookings to get the room or unit you desire. Come and go as you please, dropping in for long holiday weekends or stopping in in the middle of the week without having to make a reservation.

If you're one of the millions of people enjoying remote work, you could opt to work from your vacation home, extending your time closer to the amenities you desire. Imagine the invoice from booking a hotel or long-term rental for one month compared to a mortgage payment for a second home.

Most importantly, our vacation time is about reducing our stress and improving our overall quality of life. A vacation home where you recharge your batteries. It's even more relaxing when you control the home's amenities, interior decor, and privacy. Friends and family can join you, making it a space for good times with those you love the most, creating cherished memories for years to come.

What to consider before buying a vacation home

Purchasing a vacation home generally follows the same process as buying any primary residential property. Do factor in some additional considerations as you decide to buy a vacation home.

#1-Is now the best time for you to buy a vacation home?

Balance the local real estate market and your lifestyle. What's going on may mean it's not the best time for buying a vacation home. Maybe your kids are in high school; you're frequently driving around, getting the kids to and from their extracurricular activities, college visits, and saving for tuition. Perhaps your aging parents are running into some medical issues, and it may be better for you to stay closer to home more often. If you're not likely to frequently use the vacation home, maintain it, or be in a robust financial position, it may not be best to buy now.

Even if your personal life is arranged so that second homeownership is a possibility, do factor in what's happening with the local real estate market where you are considering buying a vacation home. Modestly priced homes aren't really in the budget for many builders with labor and supply shortages. Luxury vacation homes may be more available on the market unless you are in a high-demand location.

Another contributing factor? The availability of real estate. More people may be living where you prefer to vacation. Many people exited densely populated urban areas during the pandemic, so more properties ideal for second homes may already be occupied. The resulting low inventory and higher demand increased median prices in less populated suburban areas and towns. Demand for all types of real estate directly impacts the local vacation housing supply.

#2- Establish the purpose of owning a vacation home

Have a conversation with your partner and real estate agent about why you want to purchase a vacation home. What do you want to get out of your ownership? Get all parties on the same page. Some questions to answer:

- Will this vacation home be for your whole family?

- Are you seeking a second home closer to your family?

- Do you think you might eventually retire to this home?

- Do you intend to rent the home when it is not in use?

- Will it be more affordable to own the vacation home or is it more financially savvy to continue renting as needed?

The answers help determine where you will look for a second home, what features you would like the property to have, and start the budgeting process. After all, if you want the entire family to vacation in this home, you need enough room to accommodate them. If this home is potentially a retirement home, you may want a larger kitchen, more storage space, and yard space than buying a vacation home to visit a couple of weeks out of the year.

Buying a second home now as your full-time retirement home can be a financially smart decision. While still relatively young and generating a large income stream, purchasing this home enables you to afford both properties. You'll start building equity in your second home while still increasing the equity in your primary home. That way, when it's time to sell your primary home and move to your vacation home, you'll have a larger nest egg to draw from. You may be able to use the proceeds of the sale to pay off the second home or to pay off a large portion of the mortgage and refinance for lower payments.

Setting the purpose narrows the search for the ideal vacation property. Let's say you are planning to buy a condominium as your vacation home. Some condominium complexes do not allow owners to rent their units. Others have restrictions on how many days a condominium can be rented out, or they stipulate how long you must own the property before you decide to turn it into a rental. Let your real estate agent know if you plan to buy a condominium to rent, and they'll steer you to properties that allow vacation rentals.

#3- Set a second home budget

Just like buying your primary residence, create a budget for your second home purchase. Look at your available cash and liquid investments. Decide how much you are willing to fund for a down payment, if you will finance the property, and how much you want your total monthly payment to be.

Factor in all the costs associated with your vacation homeownership. In many destinations, the property taxes on a second home are more significant than the primary residence tax. Include property taxes, insurance, utilities, HOA fees, and maintenance expenses when creating the budget.

Keep in mind that vacation homes can be expensive in popular destinations. In some cases, the median price of the home can be double what you paid for your primary residence. Do your research when you are picking out where you want your vacation home to be.

If this vacation home will be rented out, research your options for managing the rental process and general upkeep. Who will look after the vacation home when you're away? Will you be hiring a property manager or a vacation rental firm? All of these add expenses to vacation homeownership. Even if you're not renting the home, you still need someone to check on the property regularly to protect it from vandalism or unexpected damage.

The process for buying a second home

#1- Determine your financing

For all-cash vacation home buyers, financing isn't a consideration. If you will finance the vacation home purchase, start talking to lenders early.

The most common mortgages are for primary homes and investment properties. What if your vacation home isn't going to be a rental? You won't qualify for a conventional mortgage. There's a special category of financing for vacation homes and non-primary residences.

These "second home" mortgages can be more difficult to qualify for than primary residence loans. The lenders want proof that your income justifies your ability to pay two mortgages. The terms in second home mortgages may restrict your ability to rent the property if you change your mind in the future. Some lenders will not originate a second home mortgage if you plan to rent at all.

Be ready for the lenders to charge a higher interest rate and expect a higher down payment requirement than for a primary residence. The reasoning is simple: if borrowers run into financial trouble, they are more likely to continue making payments on their primary home. Lenders want borrowers to have more skin in the game when it comes to second homeownership.

#2- Decide on the vacation property type

Another consideration is what kind of property you would like to buy, such a condo or a single-family home. Condos are a common choice for second homes and vacation homes. There's less maintenance because the common areas are taken care of by the condominium HOA. You don't have to worry about the landscaping. Condos often have built-in security and offer additional amenities, such as a pool, outdoor kitchen, dog park, or fitness center.

In exchange for this convenience, the condominium will have an association and charge fees. Budget for these HOA fees as part of your ownership and expect them to increase over time. You also could be subject to a special assessment for capital repairs. If the condominium association has not been adequately run, you could be on the hook for thousands of dollars that you didn't expect. Do your due diligence when buying into a condo. Your real estate agent can help you find a solid complex, review the documents, and get access to the budget when buying a condo.

On the other hand, buying a single-family home provides you with more privacy and space. If you plan to turn this into a whole family vacation retreat, you'll need the extra rooms and outside space. You'll have more control over the personalization and won't necessarily have to deal with HOA fees unless you buy in a community with a homeowner association. You have more choices; your vacation home can be a cabin on a Texas ranch, a fishing retreat on one of our lakes, or a villa in a maintenance-free community.

#3- Consult with your tax advisor

Vacation homeownership comes with tax implications. Before buying, talk with your tax advisor about how owning a second home can change your IRS bill. It could be possible to deduct your mortgage insurance and property taxes just as you would for your primary home. However, if you plan to rent at all, you might not qualify for these tax breaks. The key test is you must live in the home at least two weeks out of the year or at least 10% of the days that it's rented out.

Put another way, if you buy a townhome on the beach and rent it out for 90 days out of the year, you must spend at least nine days out of the year there to consider it a vacation home for tax purposes.

You can deduct property taxes paid on primary and vacation homes. Just keep in mind the state and local tax deduction limit of $10,000. In many cases, when you buy a second home, your taxes will exceed that limit.

Consider the tax implications of selling your primary residence or second home. You can exclude up to $250,000 in capital gains from your taxes when you sell a primary residence. That isn't the case if you sell a vacation home. Expect to pay capital gains taxes on any sale profits.

Will you be renting this vacation home to help offset its expenses or to generate income? Be ready for property management fees. For vacation rentals, property management fees are often greater than what you would charge for a long-term rental property, and there's simply more work that goes into short-term vacation rentals.

You also must report your rental income on your tax return. The good news is you can deduct expenses from this income. If the IRS considers your vacation home an investment property, you won't be able to deduct the mortgage interest or property tax from your personal tax bill. Still, you can deduct it from your taxable rental income and use the investment property depreciation deduction. Those can significantly impact your tax liability. Again, the complexity around second homeownership and its use are why it's essential to consult with your tax advisor.

#4- Hire a local real estate agent

Some destinations have restrictions on rentals. It's important to communicate to your real estate agent if this vacation home will also be used as a rental property. It could limit where you buy your vacation home. Local agents with experience in the vacation home market can advise you about popular areas with tourists, busy seasons and pinpoint excellent deals for a vacation rental investment. This information is also helpful if you're not planning to rent, as they find a quiet community away from crowded tourist areas.

#5- Have a maintenance plan before you buy

Keeping up your vacation home will be your responsibility, whether you choose to do it yourself or pay someone else to do it. If a pipe springs a leak and you don't discover it for months, it will increase the amount of damage in your home. You'll need to have someone look after your property when you're not there. You also need to take care of its landscaping, pest control, and essential systems. Vet the vendors that will check up on your potential vacation home.

Implications of a second home in Texas

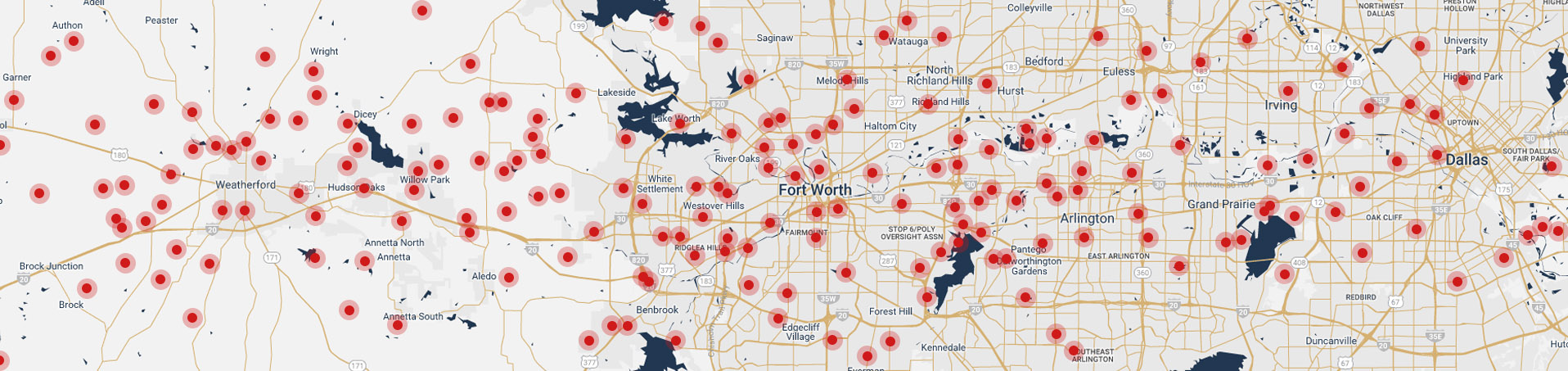

In a state as diverse and large as ours, your vacation home may be in the state. For example, many Fort Worth residents own a second home along Eagle Mountain Lake. It's a convenient retreat from the daily hustle of Fort Worth living.

Texas does not have a state property tax, and all our property taxes are locally assessed and locally administered. These taxes provide funds to pay for schools, roads, emergency services, libraries, parks and recreation, and other services controlled by the local government. You'll need to check with the specific county where you buy your second home to see what your tax burden may be.

You cannot qualify for a homestead exemption for more than one residence. This homestead exemption only applies to your main or principal residence.

Looking for your vacation home

Buying a vacation home can be an exciting adventure for you and your family. This place will create joy and lasting memories. Make your purchase a solid investment by walking into it fully informed about what it means to be a vacation homeowner. Consult with a tax professional and your real estate agent before you begin your housing hunt. Chicotsky Real Estate Group is happy to answer all of your questions about vacation home ownership, assist you with the search, and provide referral information.