Investing in real estate can be a great way to protect your financial future, especially during times of recession. Looking back at the other recessions over the last 40 years, real estate assets tend to fare much better than other investments regarding long-term appreciation gains and producing income. It's particularly notable in some specific niches.

Given that economic experts have been talking about a recession since the start of the pandemic, and with rising inflation causing the Federal Reserve to raise interest rates throughout 2022, each passing month makes a recession more likely. In fact, the notes from the Federal Reserve's March 2023 meeting show the institution expects the string of banking failures from early 2023 to tip the scales and bring on a recession by mid-to-late- 2023.

Their prediction is for a mild recession that will recover by 2025. Still, even these officials don't know with great certainty the depth and breadth of any potential economic turndown. It's still conjecture based on past recessionary markets, current information on GDP and inflation rates, and forecasts drawn from both factors. In truth, anything can happen. The recession could be deeper or last longer than experts believe.

Making moves now to strengthen your financial portfolio and investments sets the stage for long-term stability and growth on the back end. And recessions aren't all bad news if you're prepared. By taking advantage of market conditions during recessions and investing in real estate assets that have proven resilient over time, you can create much-needed stability for your investment portfolio.

Even if you're not ready to invest in real estate, and are just concerned about buying a home in a down market, doing so now can increase your future wealth. Why? Real estate offers:

Investment Stability

Real estate is considered a relatively stable asset class based on its past performance in down markets. It continues to provide investors with a steady source of income.

Consider the typical pattern of recessions. Businesses tighten spending, reduce hiring, and lay off employees. Individuals cut back on spending, delaying large purchases and incidentals like vacations, further impacting overall economic growth.

But it's not that individuals aren't spending. After all, people must meet their basic needs. It's these sectors of the economy–the essentials––that tend to perform well during a recessionary market. Because people need a place to live, housing tends to perform well during a recession.

It's noteworthy that rental stability and performance often remain relatively constant, even as the markets wax and wane. Between 2007 and 2009–the Great Recession–the rent of a primary residence increased approximately 4%, as per the Consumer Price Index (CPI). For investors, that means multi-family and single-family rental properties can provide a consistent income stream.

Investing in other real estate assets like commercial and investment trusts can also have gains. According to the National Association of Real Estate Investment Trusts (NAREIT), in the last six recessions, REITs outperformed private real estate during the recession and the following four quarters.

Commercial real estate sectors like self-storage and short-term flex space, which have shorter lease durations, can rapidly adjust their rents to match inflation. They exhibit more cyclicality and can work as a protective measure against inflation.

For the homeowner, it's encouraging to know the value of their home may remain stable, or even grow, during a recession, even as their stocks fluctuate and report losses.

Post-Recession Returns

Investing in real estate is a long-term game no matter what kind of economic conditions, but real estate investing while anticipating or during recessions means planning for the outcome when the markets bounce back. Anticipate smaller returns in the short-term but better future growth once the economy exits the recession.

According to one report, real estate investments tend to yield superior returns after periods of economic recession. So if the officials are right, and we're entering a recession by the end of 2023, now is the time to buy to maximize returns in 2025 through 2027.

Real estate is also a natural hedge against inflation because property values typically increase over time. Since 1963, average home sale prices had consistently risen, with the one exception being the Great Recession of 2008, when poor lending practices led to a housing crash. It took five years to rebound to pre-crash housing prices, and then there was a period of market stability.

Other investing arms will eventually return to pre-recession levels, but it takes time.

On average, since 2000, it has taken 647 trading days for the S&P 500 to reach pre-recession levels after the United States has exited a recession. The NASDAQ usually takes about 330 trading days. It's important to note that there are approximately 253 trading days per year, so you're looking at an average of at least a year to see stock markets regain their peak losses.

The key takeaway is that investing in real estate during a recession often yields superior returns to other asset classes once the economy bounces back.

Tax Benefits

Homeowners can write off the interest on their home's mortgage, home equity loans, property taxes, and some qualifying home improvements as part of the federal tax filings.

Even more savings are available for real estate investors who can take advantage of tax benefits, such as deductions for mortgage interest, property taxes, and depreciation. As an added bonus, these deductions remain in place even during recessions. And, as you're running a business, you can deduct the expenses of running the property, like property management fees, building maintenance and repairs, marketing, and legal fees.

All these deductions drop your taxable income as long as you're keeping accurate records in case of an IRS audit.

Inflation hedge

Real estate is a natural hedge against inflation because property values tend to increase over time. Just look at what's happened over the last two years.

The market rebounded from a 2020 low to post double-digit appreciation gains in many markets nationwide. In many cases, the appreciation was recording setting. As of January 2023, nationwide home appreciation was 19.1%, its highest gain in 45 years! Texas median home prices rose about 13% from 2021 to 2022.

From 2022 to 2023, median home values in Utah, Arizona, and Florida were projected to grow by over 20%. Texas had a projected 15.29% home value growth rate, a gain of $44,422.

That's far outpacing inflation, which stood at 4.98% in March 2023. Inflation rates averaged 8.54% last year, and most experts project them stabilizing around 6-7% this year.

Granted, these gains in housing prices were brought on by an intersection of unique factors, including the nationwide housing shortage. And every local market has weathered different conditions based on supply, demand, home prices, and migration. Some overpriced markets have been reporting price corrections as the economy slows and stabilizes.

Nonetheless, these gains demonstrate real estate's power to increase value even in a down market. Few other investing arms have that same consistent power.

Preparing to invest for a recession

Investing in real estate during a recession presents an opportunity for long-term growth, stability, and economic security. With careful planning and research, home buyers and investors can take advantage of the current market conditions with confidence that their investments will weather future economic turbulence.

As always, consulting with an experienced financial advisor before making any investment decision is important. Before your purchase real estate, take these steps:

Do your research

Taking full advantage of the potential rewards of investing in real estate during a recession requires careful strategizing and understanding the complexities of this asset class. Real estate investing is not without risks, but when done correctly, it can provide substantial returns and financial security even during turbulent economic times.

You have various options depending on how hands-on you want with your real estate. Maybe it's enough to move from renting a home to becoming a homeowner and investing in your future that way. Or, perhaps you're interested in expanding into owning real estate as an investment or income-producing vehicle. You can start flipping houses, owning a single-family long-term, running a vacation rental, or stepping into commercial real estate. These can be as hands-on or off as you like, through hiring contractors, property management firms, or investing as a partner while letting an asset manager handle the day-to-day. The amount involved to start and potential returns vary widely.

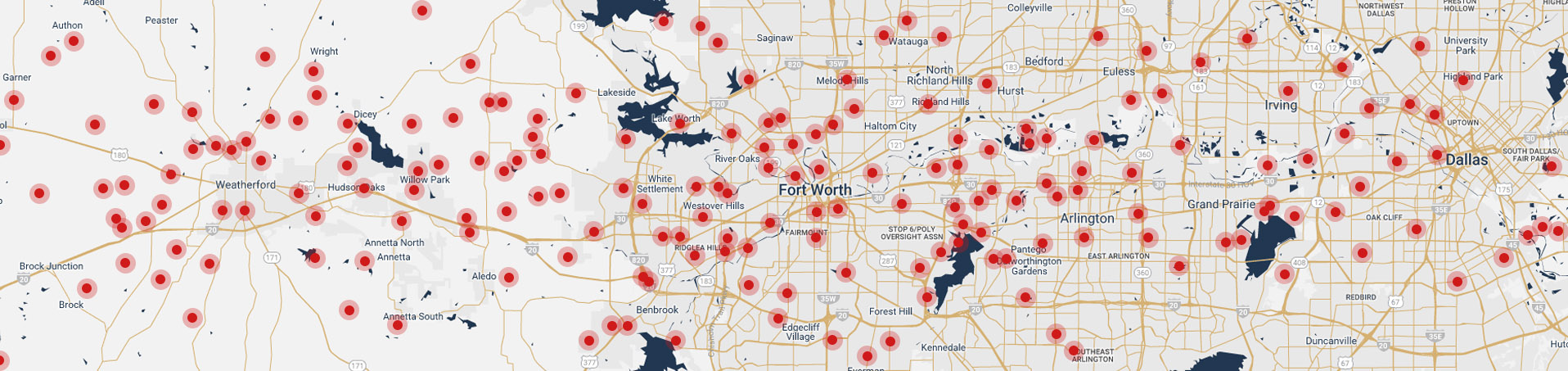

Look for properties in stable areas with a history of strong rental demand. Fort Worth ranks as Texas' fourth-most competitive real estate market, with 95% of properties occupied by tenants and with tenants who renewed leases. An average of 13-15 candidates competed for the same vacant multi-family apartments, and these properties were vacant for an average of 33 days.

Avoid areas that are likely to experience significant economic downturns. As the nation's 13th largest city, the median household income in Fort Worth is high, and its unemployment rate is well below the national average. The whole Dallas-Fort Worth metro hadits GDP grow 3.1% in 2022, and it was the fifth-fastest growing economy of any US metro area.

To be even more hands-off, REITs are an option. Listed real estate investment trusts (REITs) tend to perform better in selling off and recovering during times of recession. However, there may be short-term disparities in pricing between listed REITs and private real estate. By comprehending the differing behaviors of these two markets, real estate investors can strategically diversify their investments across both asset classes and potentially reap benefits by timing their investments based on market conditions.

Finally, consider the potential tax benefits associated with real estate investments. Real estate investors can use deductions for mortgage interest, property taxes, and depreciation to reduce their overall tax burden. A 1031 exchange can preserve your capital gains and enable you to upscale your real estate investing.

Consider cash flow

Focus on properties that generate positive cash flow, meaning the rental income is higher than the expenses associated with owning and operating the property. This will help you to maximize your return on investment. Plus, positive cash flow will help hedge against any potential market fluctuations.

Run the numbers before you buy on the current market rates for leasing the property. Use comparable supplies from local real estate. Estimate your expenses from the mortgage payments, taxes, insurance, and maintenance fees.

Add value

Smart investors look for undervalued or underutilized properties they can improve and add value. Consider making renovations that increase the property value and attract more tenants. Not all renovations have to be expensive. It's amazing what new paint and fresh landscaping can do to make a single-family rental more attractive.

Or, in the case of commercial real estate like multi-tenanted properties, improve the property management to fully optimize its operations and reduce expenses. This can help to increase the property's value and make it more attractive to commercial tenants, even during recessionary times.

Plan for the long-term

Consider the long-term value of investing in real estate during a recession. No expert has a hard and fast idea of when a recession will start, how long it will run, and how muc time the economy needs to recover. It often takes 3-6 months of consistent down markets for experts to declare an official recession. If you look at data back to 1853, the average recession length is 17 months, but since World War II, most recessions have lasted closer to 10-11 months.

For this reason, plan for the long haul. Like any major purchase, don't buy without an exit strategy. Make sure you have a long-term strategy and stick to it.

Invest with caution and discipline. Know exactly what asset class and investing you'll be doing, its potential risks, and your goals. Don't bet on future markets.

Investing in a recession can be risky, so it's important to understand the potential risks.

Investing in real estate for a recession

Real estate investing doesn't guarantee a recession-proof portfolio, but it can provide great protection when the economy takes a downturn. By understanding the opportunities of real estate investments in recessionary times, investors can set themselves up to make gains in the long run. Plus, purchasing rental properties may provide more stability than other investment classes since people always need somewhere to live, no matter what's happening in the markets.

Thus, investors should seriously consider adding real estate investments to their portfolios to help prepare for any potential economic turndowns. The Chicotsky Real Estate Group is happy to discuss the advantages of buying real estate in Fort Worth and share our experience investing in our local markets.