What is a Prequalification Letter and Why Does My Real Estate AgentWant One?

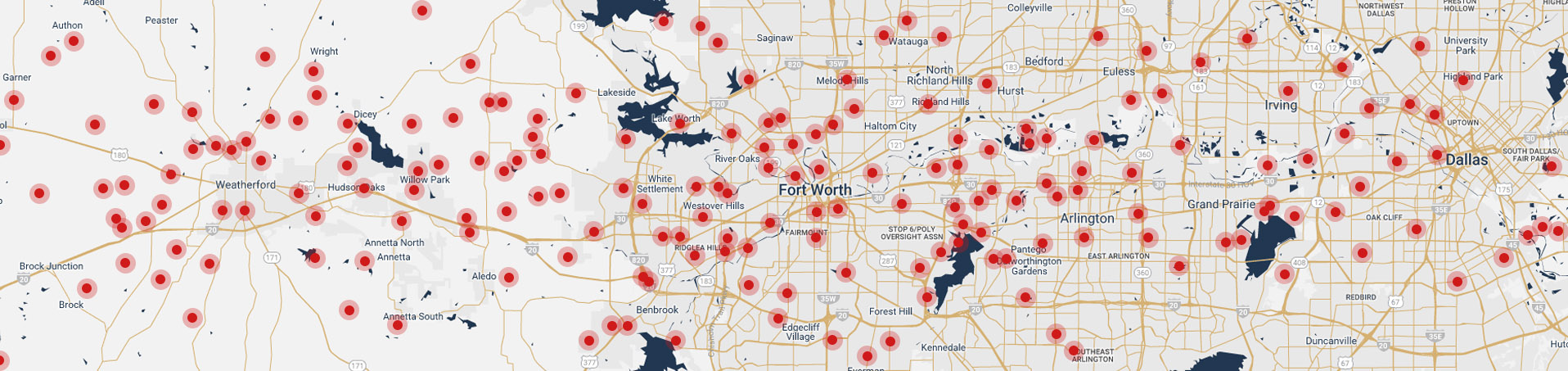

Anyone interested in financing their home purchase must first work with a mortgage lender to get pre-qualified. Taking this crucial first step will result in a buyer receiving a pre-qualification letter and is what we call in the industry, a pre-qual for short. There are many intricacies involved with a pre-qual and a good listing agent will be able to sniff out a strong pre-qual versus one that was haphazardly put together. Put yourself in the position of a listing agent or seller: would you rather receive a pre-qual from a lender who offices at the corner of W 7th Street and University Drive or a pre-qual from a mortgage broker operating out of some other city?

Getting pre-qualified is the initial step in the mortgage process, and it's generally fairly simple. You supply a bank or lender with your overall financial picture, including your debt, income and assets. After evaluating this information, a lender can give you an idea of the size of the mortgage for which you qualify. Pre-qualification can be done over the phone or on the internet, and there is usually no cost involved. Loan pre-qualification does not include an analysis of your credit report or an in-depth look at your ability to purchase a home. The initial pre-qualification step allows you to discuss any goals or needs you may have regarding your mortgage with your lender. At this point, a lender can explain your various mortgage options and recommend the type that might be best suited to your situation.

Because it's a quick procedure – and based only on the information you provide to the lender – your pre-qualified sum is not a sure thing; it's just the amount for which you might expect to be approved. For this reason, being a pre-qualified buyer doesn't carry the same weight as being a pre-approved buyer who has been more thoroughly investigated.

Why is a pre-qual so important? Without a pre-qual, it's not good business practice for an agent to show homes to you, the potential buyer. An agent of the caliber of David Chicotsky definitely won't submit an offer without a proper pre-qual. Not only does it put the agent in an ethical bind, it hampers their ability to help their buyer get the house. Having a pre-qual gives the buyer the ability to put an offer in right away in order to secure the home. In this very competitive real estate environment, buyers need all of the arrows in their quiver to be successful.

Real estate agents have no way of knowing what loan amount you qualify for, how your credit looks, how much you make, how much you already owe, or if you have enough cash to close. All of these factors help a lender decide which product you qualify for, it also allows the mortgage broker to help the buyer improve their credit or make corrective measures if needed. My company has several dozen banks to draw from, allowing me to scrutinize your finances and find you the best lender to underwrite your loan. Sellers are picky about loan types in competitive situations. As an example, unfortunately, sellers generally try and stay away from accepting a VA or FHA loans - instead preferring all-cash deals, or a conventional mortgage.

In general, you’re not going to be able to send in an offer without a pre-qual (unless of course it's an all-cash deal), so if you were to find something you just couldn't live without - not having the pre-qual ready to go could cost you the opportunity of securing the purchase that day. In the Fort Worth market, buyers need to be ready to pounce on a house like a cat on a mouse. I've seen several deals lost by waiting even one day. I've also witnessed the price of a home go up by 5% overnight; instead of putting an offer in being the only offer on a property - if two other offers come in that night you're now in a multi-way battle for the house. These multiple offer situational battles inevitably drive the price of the house up and many times this can be prevented by being prepared with a quality pre-qual beforehand.

As a good general rule of thumb, buyers should always try to use local lenders or small, regional, boutique lenders. They're usually more responsive, the deals typically close at a faster pace and it's easier to get in touch with them. Their processes will be more streamlined than a big bank. Larger banks often funnel a lot of buyers into a small pool of underwriters, causing a traffic jam that might force you to delay closing. That’s a headache you, your agent, or your seller will not want to have to deal with, and a proactive look at a local lender can prevent this.

Perhaps most important to you, though, is that a lender's ability to answer his or her phone on the weekend, could be the difference between getting a house or missing out. Have you ever tried to go to the bank on a Saturday afternoon or a Sunday? Likewise, those are the times you’re most likely going to be looking at properties and will need to get a hold of your lender. I would say at least half of all offers I've put in have been over the weekend. The rest of the world works on a Monday through Friday schedule, realtors work 7 days a week and especially on the weekends. One negative of working with a big box lender is you'll see them divide the file up between multiple individuals, oftentimes in multiple locations.

For example, I've seen big box lenders send the paperwork during one of the stages towards underwriting from Fort Worth to their office in San Antonio. If you inquire into the file to see where you're at in the mortgage underwriting process, they'll actually tell you the San Antonio office has 7 days to respond to this office with the document. So not only do you not have one mortgage broker overseeing the entire file, making communication between mortgage broker and client more difficult - it often greatly slows down the process. We almost never have a file take more than 30 days, many times we need a week or two less than that. You can expect the big box mortgage lenders to take upwards of 40 or 45 days. This puts buyers in a greatly disadvantaged position to get the property under contract.

Now that we’ve covered the in’s and out’s of the importance of getting pre-qualified, let's look at an example of a common scenario that occurs with a pre-qual. This will give you a better feel for the process you’re about to begin.

Ryan pre-qualifies a buyer at $200,000. The buyer finds a home that he likes that he wants to put an offer in for $180,000. At this time, the buyer's agent will call Ryan and have him send over a $180,000 pre-qual letter to match the offer you’re making. Best practice dictates sending the pre-qual over at the exact amount being offered; a buyer's agent has a duty to shield their client from giving away too much information relative to the strength or weakness of their financial position. Telling a seller that you qualify for $250,000, but offering a low amount of $180,000 might induce the seller to over negotiate with the hopes of increasing the buyer's offer substantially.

Keeping our cards close to our chest, by submitting a matching pre-qualification letter signals to the seller that you’re able to communicate effectively with the mortgage broker, that you’re more likely to complete the purchase – without giving away too much information. Oftentimes we'll end up putting in the $200,000 offer, then let's say the seller counters with $210,000 and the buyer wants to counter at $205,000. In this instance, the buyer's agent will want another pre-qual to submit with this final offer. So it's not enough for a mortgage broker to answer their phone on the weekend, they have to be able to stay in touch with the buyer and the buyer's agent to deliver further pre-quals when needed.

One thing that David Chicotsky does that's smart is he encourages the listing agent to reach out to me, to verify the strength of the buyer. Having a local lender allows aggressive agents like David to submit offers on a moment's notice, accommodating the sale by working on the buyer's schedule. Recognizing that a home purchase is usually the largest purchase a person makes in their lifetime, I respect the client and their agent enough to be able to stop what I'm doing and help them when they need me.

Some pre-quals are better than others - some will indicate the mortgage broker has reviewed all written documents, lending strength to your offer in the eyes of your seller; while others will mention the mortgage broker hasn't seen these documents. Clearly there is a big difference in the relative quality of a pre-qual in which the mortgage broker has seen and reviewed all pertinent documents vs. a mortgage broker who hasn't. David has an interesting take on these two very divergent pre-qual letters, he calls the pre-qual where the lender has reviewed all of the documents a 'real pre-qual' and the weak pre-qual a 'fake pre-qual' letter.

Have a conversation with your lender about which documents you can send in quickly to strengthen the letter they can give you. It’s easier than you think and it saves you from having to inevitably submit these documents during the underwriting process anyways. You'll need to put together and submit your last two years of tax returns, your last two bank statements, your last two paycheck stubs, your driver’s license, social security card, as well as retirement statements when applicable as they can make your letter shine. Having all of this info submitted to your mortgage broker will allow him to present you with a strong pre-qual letter that will give you a leg up on the competition when submitting an offer in a multiple-offer situation.

What if the offer price in the prequal letter isn’t actually what the house is worth? The mortgage lender you work with will order an appraisal. Technically speaking they call a 3rd-party appraisal coordinator who blindly orders the appraisal, creating a layer in the ordering process that thwarts any potential conflicts of interest or fraud. Appraisals usually take 5 to 10 days between being ordered and being completed. During the busiest times of the year there is a back-log of appraisers, because the requirements to become and maintain the appraiser's license is extremely rigorous involving thousands of hours of apprenticeship and course work. Don't expect a flood of new appraisal licenses being acquired anytime soon.

Having a responsive and quick mortgage broker will ensure your appraisal is ordered the first day the contract is executed and it's sometimes possible to get the appraisal back while you're still in the option period. This step will impress your seller, and will also serve to ensure you know the fair value of your home and you’ll be able to close on time. Starting May 15th, 2018 the Texas Real Estate Commission promulgated a specific appraisal addendum dealing with the options possible if a house doesn't appraise for the contract value.

Knowing whether a home will appraise or not is critical information that the buyer's agent and buyer will be able to decide whether to further negotiate the price of the house or send in the termination agreement and go out of contract while under the option period. It’s not important to deal with this up front when you’re being pre-qualified, but it’s good to let your lender know if you think the house might appraise lower than you are offering. Scrupulous agents like David will always provide the buyer with comps or a comparative market analysis, known as a CMA, in order to substantiate the value or lack of value of a property - before an offer is submitted to the listing agent. A nuanced point of information: If the value of the home is lower than you estimate, it can affect the interest rate you’re able to obtain. In general, higher loan amounts lead to lower interest rates, since lenders can count on a higher amount of interest pouring in every month as you pay your new mortgage payments.

You can rest easy knowing that getting pre-qualified and making an offer on a house does not lock you in to that property. Nothing we’ve written about here constitutes a “point of no return” in the home buying process. In the state of Texas, you’re allowed to walk away from any real estate transaction during the option period, no questions asked. Technically speaking, you have the unequivocal right to refuse a property for any reason or no reason at all during the option period. The option period in the state of Texas is sacred; it's a period of time for the buyer to do their due diligence and mitigate their risks associated with the property. Once a house goes under contract, it's the buyer that can now walk away (during the option period) while the seller is committed to the contract. If damage is found during the inspection, the seller can refuse to negotiate allowances for repairs, but ultimately has no leverage or ability to walk away from the contract.

If you choose to walk away during the option period, you are able to recoup the earnest, though the option money paid to the seller is not refundable. A special note on appraisals: though some lenders will require you to pay for your appraisal up front; if the appraisal has been completed - the costs associated with the appraisal is usually not refundable. Most lenders won’t require you to pay for the appraisal until closing, so if you’re asked to pay you can negotiate, or choose another local lender who won’t ask for nickels and dimes out of your pocket during the home buying process. If you think a home will need some repairs done, it may be best to wait on having your appraisal completed until the negotiations about repairs have been completed. This essentially gives you two chances to negotiate what will be the final contract price.

It’s unreasonable to expect that you’d memorize all of the information contained in this article, but frankly, that’s why mortgage companies exist. When you go to the dentist, you’ve probably never scrutinized his training and practices, and you trust him to take great care of you. Your relationship with your lender should be no different. If you encounter a lender that smells fishy or tries to have you pay for services up front, you need to know you’re welcome to explore other options. Would you stay in a dentist’s chair for a filling if you had any suspicion something wasn’t right? There are a ton of great mortgage lenders who want to provide you the most ethical, personal service possible, at the right price, on a timeline that works for you. Use the pre-qualification process as a trial run for your chosen lender, and if you aren’t pleased, get a second opinion to find someone who works better for you. I take great pride in working hard for my clients and in turn helping out agents like David; ultimately when working on a deal the buyer becomes a client of both of us.