If you’ve spent any length of time in rental apartments you know about pesky neighbors, noise, landlord rules, rent increases, and leases that can be changed or cancelled with little to no warning. Perhaps you’ve been frustrated once or twice with close neighbors that may or may not be clean and you’ve asked yourself what it takes to own your own home. Are all home buyers like the ones on HGTV with $900,000 budgets that can never find what they’re looking for? Do you have to save some ridiculous amount of money for a down payment before you can purchase? What about the housing market, is now even a good time to purchase property? Maybe you’ve owned before and lost or sold your home. You may have the finances now but are uncertain about the housing market. You are not alone. Renters throughout the city are contemplating whether now is the right time to purchase. Let’s weigh the options by discussing: The Forth Worth Housing Market, What Buyers Want, The Pros of Buying, What Renters Want, The Pros of Renting, The Costs of Renting, The Cost of Buying, The Cons of Renting, The Cons of Buying and How Does One Determine What is Best.

The Housing Market

The Texas housing market is booming with possibilities for new buyers. The US Census states that Texas continues to have strong population growth. For each year between 2010 and 2016, Texas has had the nation's largest annual population growth. During this period, the state added about 211,000 people per year through natural increase. Growth is great for property values! However, consistent population growth also sends rental prices on the rise.

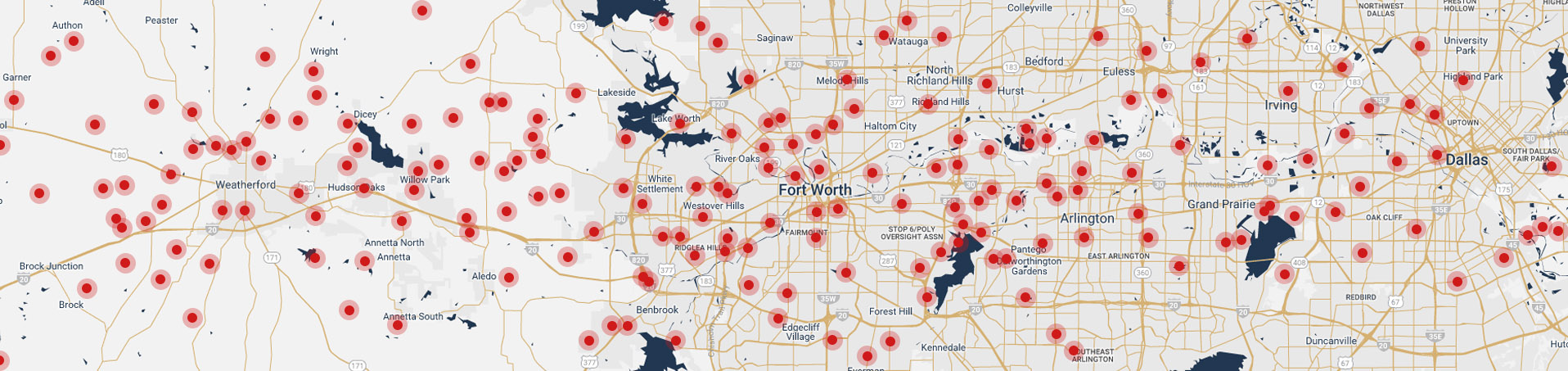

Though the economic strength in some Texas cities is weaker than in others, the Fort Worth-Arlington area is the third best housing market to purchase a home says Forbes magazine in April of 2018. Population growth has been good but not too strong to overwhelm the real estate market, job growth is steady, and ranks higher than many other Texas cities. Fort Worth is currently a great area to purchase a home, investment property or land.

Buying a home is a big financial investment – notably one of the biggest single investments you'll make in your life. Buyers must do their homework and carefully evaluate how they want to live and how much they can comfortably afford. Homeownership is rewarding when buyers are properly prepared, know what to expect, and make informed financial decisions. Having an expert to walk them through the process makes purchasing stress free and enjoyable. Chicotsky Real Estate Group has professionals with the knowledge and experience necessary to assist you with all your real estate purchase needs.

Why Buyers Really Buy

The number one reason for home owners to purchase a home is to save money. Purchasing land and property is always an investment. It’s a commodity that appreciates and can be passed down through generations, growing and building wealth. Think about newest shopping plaza you’ve seen. Someone owned the land that was in high demand for the retailers to pay millions to purchase. It doesn’t stop there; the price of land increases every year. Over decades buyers make thousands of dollars for just owning and maintaining their property. Many buyers use properties as a retirement plan as each payment builds equity towards their mortgage payoff. In addition, owning your primary residence is a great tax shelter providing millions of Americans with a needed deduction annually.

Many of the other reasons to purchase a home rival one another. For instance, homes provide buyers with privacy from creepy neighbors and vagrant neighbors that are consistently moving in and out of complexes. Home owners have the ability to alter their home to their personal style and liking. Homes also provide home owners with a stable environment to raise children and grow their families. Memories are captured in the home with holidays and significant events. Finally, home ownership allows buyers to take part in the American dream of owning the soil in which they live. Home owners are perceived as having vested interest in the community they purchase within.

Pros of Buying

Saving money is the main positive in buying a home. Home ownership is a long-term investment that builds wealth and provides buyers with a major asset should they ever need to borrow against their investment. Secondly, purchasing gives buyers the flexibility to have as many or as few house guests in their home without the hassle of updating tenant lease contracts. Buyer’s can paint, change walls, and upgrade their homes as they desire.

Why Renters Really Rent

The majority of renters rent for financial flexibility. Many enjoy not having a long term financial commitment to sell if they decide to take a higher paying job in Florida. Renting allows renters to have career flexibility, low maintenance costs, low market risks and the flexibility to frequently move anywhere they wish. For many millennials, the high costs of debt and loans detours them from saving the necessary nest egg to purchase and maintain a home. Many renters have postponed purchasing a home because of a lack of down payment, low credit scores or because they have too much unsettled debt. Renters that have student loans in default are also not eligible to get financing to purchase a home. Finally, renting also helps to build credit history to assist renters in eventually making a home purchase.

Pros of Renting

Many Renters aren’t interested in replacing large ticket items like roofs and air conditioners. Home maintenance items that cost over $5,000 to purchase can be difficult for growing families. In addition, there is a large amount of convenience in being able to call the property management office and having a free repair completed. However, free repairs are not free. Maintenance teams receive their pay form the compounded monthly payments renters make. Renters enjoy the ability to pay for their maintenance fees in small monthly increments rather than wait 30 years to replace a $10,000 roof or 25 years to replace a $6,000 air conditioner unit.

The Costs of Renting

To compare apples to apples, let’s compare the cost of renting a three-bedroom apartment to the cost of purchasing a three-bedroom single family home. The average cost for a three-bedroom apartment rental in Fort Worth is $1,340 per month with the average size being 1270 sqft. That price increases about 2% every year for three-bedroom apartments. For apartment rentals of any size, price increases are around 5% annually with the average rental price being $1,029 per month. Renting a single-family home is even more costly though it often provides more space and privacy. The average price for a renting a three-bedroom single family home in a Fort Worth neighborhood is $1,448 per month. For the same amount of monthly payment of the three-bedroom rental, a buyer can purchase a 2000 sqft four-bedroom home priced between $200,000 - $265,000 depending on down payment, private mortgage insurance, property taxes, and homeowner’s insurance. The cost of rentals will increase annually while purchasing freezes your payment in time. Does this sound too good to be true? It’s not. Forbes magazine says on average, Fort Worth home owners are enjoying an 10% increase in their home values every year. Similar to an auto loan, their monthly mortgage payments are reducing the principal balance owed on their mortgage.

The Costs of Buying

So, what is the investment necessary to purchase a home? The answer to this question varies on a number of factors: credit score, income, debt and even the area in which you decide to purchase. On average, buyers contribute anywhere from 3.5% to 20% of the purchase price. Some loan programs will allow buyers to purchase for no down payment or for a low down payment. For instance, many US Veterans are eligible for $0 down payment loans to purchase a home. The credit, income, and debt requirements still apply for Veterans. In addition, there are USDA loan options for some areas that provide a $0 down payment. For information on specific areas and qualifications for USDA loans, select https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do.

The Cons of Renting

There are some negative aspects to renting. The cons of renting are larger neighborhoods with more tenants moving in and out. Large neighborhoods can also equate to a lack of privacy, loud neighbors, unclean neighbors, crime, neighbors with bugs, and neighbors that don’t care about the community or the complex. Since renters are leasing space from a landlord, there are often annoying landlord rules and regulations regarding painting walls, placing holes in walls, the number of occupants allowed to live in a rental, altering rentals, and parking. Speaking of landlords, most lease agreements state that landlords can evict, not renew your lease or sell their property with short notice. This could leave you and your family homeless and searching for a new rental quickly. The worse aspect of renting is you walk away with nothing. Your monthly payments don’t provide a tax shelter and are never returned to you with or without interest. Financially, renting is throwing away money every month.

The Cons of Buying

The worst aspect of a home purchase is the worry of depreciation. If the housing market doesn’t continue to grow, homeowners that want to sell shortly after purchasing may lose money in their home’s sale. Buying also means there is a financial investment. Some renters don’t have the necessary funds for a down payment or for growing interest rates. The other major concern is maintenance. Everyone enjoys roofs that don’t leak but few want to invest money in placing a new roof on a home. Likewise, older homes can have costly electrical, plumbing, and structural issues. In some climates termites pose a risk of damaging homes. The other concern with buying is that it’s more difficult to sell a home than to not sign a lease agreement. It’s much easier to move around for renters and there’s no risk of them losing anything from their investment.

Determining What is Best

Let’s look a sample scenario used by the lender Freddie Mac.[3]

David and Michaela’s Sample Renting vs Buying Scenario

|

RENTAL SCENARIO |

HOMEOWNERSHIP SCENARIO* |

|

Monthly rent = $1,400 |

Purchase price = $200,000 * These inputs will result in a monthly mortgage payment around $1,400 when factoring in PMI |

* These inputs will result in a monthly mortgage payment around $1,400 when factoring in PMI

We've also put in other assumptions and costs for David and Michaela, including: a 3% home appreciation rate (though in the state of Texas this rate is much higher), a $1,500 origination charge, $1,000 for settlement services, 3% for selling costs, a 33.8% state and federal tax rate, and a savings rate of zero.

With this scenario, David and Michaela will save $92,216 by buying instead of renting over a seven-year period. If they stay in their home for 15 years, they will save $273,558. Over 30 years, they’ll save $887,450. Home owners often transfer this wealth to pay off debts, pad their retirement or assist their children. Can you think of what you would do with $273,558 extra dollars?

Renting vs Buying Questionnaire

Now here’s the hard part, which is best for you in your current situation? Renting or Buying? Here’s a short questionnaire to help you determine which is best?

Yes or No Questions

Answer the following questions with yes or no.

- Have you in the past or do you now desire to own your own home?

- Are there factors that you would like to change about your rental community?

- Is there anything in your current lease agreement that you would prefer not to abide by?

- Have you had a rental increase within the last 3 years?

- Would you like to live in more square footage than your current rental?

- With what you know now, do you think you could find a home with a comparable or lesser mortgage than your current rental payment?

- Do you have any savings (savings account, 401k, 403b, IRA) that can contribute to your down payment?

- Would you like to save money, build wealth, and have an additional tax deduction?

- Would your family benefit from the purchase of a home?

- Have you made timely debt payments and worked to have a strong credit score?

- Do you know how to contact a professional real estate agent to assist you in the home purchase process?

Score yourself 2 for every yes and 1 for every no. Score:_______

Rated Questions

Answer the following questions on a scale of 1-5; 1 being the least and 5 being the most.

- How satisfied are you currently with your rental situation?

- How likely are you to stay in the same area for 1-3 years or more?

- How reliable is your income?

- How confident are you that you and your Co-Borrower/Partner/Family can agree on the characteristics and type of home you would like to buy?

- How willing are you to set aside a nest egg for maintenance costs or purchase a home warranty to assist with any necessary home repairs?

Count your rated scores for each question. Score:_______ Total Score for all ___________

If you scored a total score of 33-47 You are definitely ready to purchase a home!

If you scored a total score of 21-32 You should thoughtfully consider purchasing a home.

If you scored 16-20 You may consider renting for another year until you are prepared for the responsibility of purchasing a home.

To answer the questions we initially asked, you don’t need a huge budget to purchase a home in Fort Worth. Nor do you need a ridiculous amount of down payment saved. Texas has an excellent real estate market and now is a great time to purchase a home. Purchasing a house will not only build wealth but also allow you the freedom to create the home you truly desire for your family. Your mortgage may even be cheaper than your current rental payment without the annoying rules of a landlord or pesky neighbors.

Whether you are definitely ready to purchase a home, thoughtfully considering purchasing a home or if you’re not exactly prepared to purchase a home the professionals at Chicotsky Real Estate Group are willing and able to help you. Contact them now for a consultation. You can learn more about homes that are currently listed for sale, find information on getting pre-qualified for a mortgage, and learn how simple it can be to purchase a home. During the consultation you can truly determine if it is better for you to rent or to buy a home.

The principle owners of the Chicotsky Real Estate Group are David and Michaela Chicotsky. They are a husband and wife team that take a hands-on approach to real estate. These professionals will go the extra mile to provide you with the valuable knowledge necessary to make your best real estate investment ever! Give them a call today at 817-888-8088!!

[1] https://www.census.gov/library/stories/2017/08/texas-population-trends.html

[2] https://www.forbes.com/sites/ingowinzer/2018/04/18/texas-offers-a-broad-range-of-real-estate-investment-opportunties/#2f3ba5a23fe0

[3] http://myhome.freddiemac.com/buy/rent-vs-buy.html