Moving Checklist:

- Empty and defrost freezer/refrigerator, plan use of food, place charcoal to dispel odors.

- Arrange to have utility disconnected at current home and connect at your new home. Though keep in mind, real estate contracts dictate you’ll need to leave the utilities on until the deal closes and funds - you can not disconnect the utilities while under contract.

- Pack strategically: label boxes with name of the room they go to, load items you need first, last for quick access upon arrival.

- Select and schedule movers and check the following: insurance coverage, packing and unpacking labor, arrival day, various shipping papers, method and time of expected payment, or reserve a truck if you’re moving yourself.

- Make arrangements for children, infants, and pets for day of move.

- Carry money, jewelry, and important documents with you or drop them off at a trusted friend or family member’s house beforehand.

- Double check closets, drawers, shelves, and the attic - make sure they are empty.

- Leave all keys and garage door openers with your agent.

- Arrange for refunds of any deposits and services.

- Contact insurance agent about your coverage of homes and movers.

- Start a file for your moving papers.

- Transfer bank funds, arrange check cashing in new city if applicable.

- New location insurance coverage: life, health, fire, auto.

- Automobile: transfer car title registration, driver’s license

- Utility companies: gas, electric, water, phone, cable

- School records: ask for copies or transfer children’s records

- Pets: make sure new tags are made

- Home delivery: laundry, newspaper, change-over services

- Health: medical, dental, prescription histories. Ask doctors and dentist for referrals, transfer records and needed prescriptions, x-rays, etc.

Change of Address needs to be sent to:

- Post Office: give forwarding address

- Bank accounts, credit cards, IRS

- Magazine subscriptions/cancel newspaper delivery

- Friends and relatives

What Does Title Insurance Cover?

Premiums: What does your premium cover?

Title insuring begins with a search of public land records affecting the real estate concerenced. An examination is conducted by the title agent on behalf of its underwriter to determine whether the property is insurable. You’ll want a title company with a highly qualified team of abstractors and examiners that review your property to be sure you have clean and clear title to your new home.

Some of the items researched are:

Review prior owner’s wills and deeds to be sure the wording and names are correct

- Are all outstanding mortgages and/or judgments released or will be released at closing?

- Are there liens against the property because the seller has not paid his or her taxes?

- Are there lawsuits or legal action that would affect the property?

- Examine the records to note of any easements and utility lines that will cause issues

Terms for Buyers and Sellers:

- AIR: Adjustable Interest Rate

- Amortization Schedule: A schedule showing the principle and interest payments through the life of the loan

- Appraised Value: An opinion of the value of a property at a given time, based on facts regarding the location, improvements, etc. of the property and surroundings.

- CD/Closing Disclosure: This form is a statement of final loan terms and closing costs. Sometimes referred to as ICD or Integrated Closing Disclosure.

- Commitment: The document by which a title insurer discloses to all parties connected with a particular real estate transaction items of recording, including title vested, exceptions to the property, including restrictions, liens, defects, burdens and obligations that affect the subject property.

- Credit Report: A report on the past ability of a loan applicant to pay installment payments.

- Document Preparation: A charge by an attorney for preparing legal documents for a transaction.

- Escrow Fee: A fee charged by the title company to service the transaction, to escrow monies. This is usually split between buyer and seller.

- Escrow Amount: Funds held by the lender for payment of taxes and insurance when due. Usually does not include maintenance fees.

- HOA Assessment Fees: Charged by the homeowner’s association as set out in subdivision restrictions.

- Homeowner’s Insurance: Protects the property and contents in case of loss; must be for at least the loan amount or for 80% of the value of the improvements, whichever is greater.

- Inspections: An examination of property for various reasons such as termite inspections; to see if required repairs were made before funds are received, etc.

- Interest: Money paid regularly at a particular rate for the use of money lent.

- Loan Title Policy: Required by the lender to insure that the lender has a valid lien; does not protect the buyer.

- Origination Fee: A fee the buyer pays the lender to originate a new loan.

- Owner’s Title Policy: Insures that the buyer has title to the property, that there are no other claims as to ownership. Among other matters, it also ensures access to the property, the right to occupy the property, good and indefeasible title, and there are no other types of specific liens against the property.

- Point: 1% of the loan amount.

- Prepaids: Items to be paid by the buyer in advance of the first scheduled payment of the loan (Homeowner’s Insurance Premium, Mortgage Insurance Premium, Prepaid Interest and Property Taxes).

- Prepayment Penalty: Charged by the lender for premature payment of a loan balance.

- Private Mortgage Insurance: Insurance against a loss by a lender (mortgagee) in the event of a default by a borrower (mortgagor).

- Realtor Fees: An amount paid by the seller or landlord to the real estate agent as compensation for their services.

- Recording Fees: An amount paid to the realtor as compensation for their services.

- Recording Fees: Charged by the County Clerk to record documents in the public records.

- RESPA: Real Estate Settlement Procedures Act.

- Restrictions: Certain limitations or conditions related to the future use of the property put on the property by a prior owner. These restrictions stay with the property until they expire or are amended as per certain procedures set forth in the restrictions.

- Survey: Confirms lot size, location of any improvements in relation to the lot and any encroachments or restriction violations.

- Tax Certificates: Certificates issued by taxing authorities showing the current year’s taxes, the last year the taxes were paid, and any delinquencies to be collected at closing.

- Tax Proration: Means that the payment of the taxes for the year of sale are divided between the buyer and seller, usually based on the amount of time the seller owned the property during that year. Prorations, and how they are calculated, are typically addressed in the Contract of Sale.

- TIL: Truth in Lending

- TIP: Total Interest Percentage: the total amount of interest the borrower will pay over the loan term as a percentage of the loan amount.

- Total of payments: Total amount paid after all payments of principal, interest, mortgage insurance, and loan costs are scheduled.

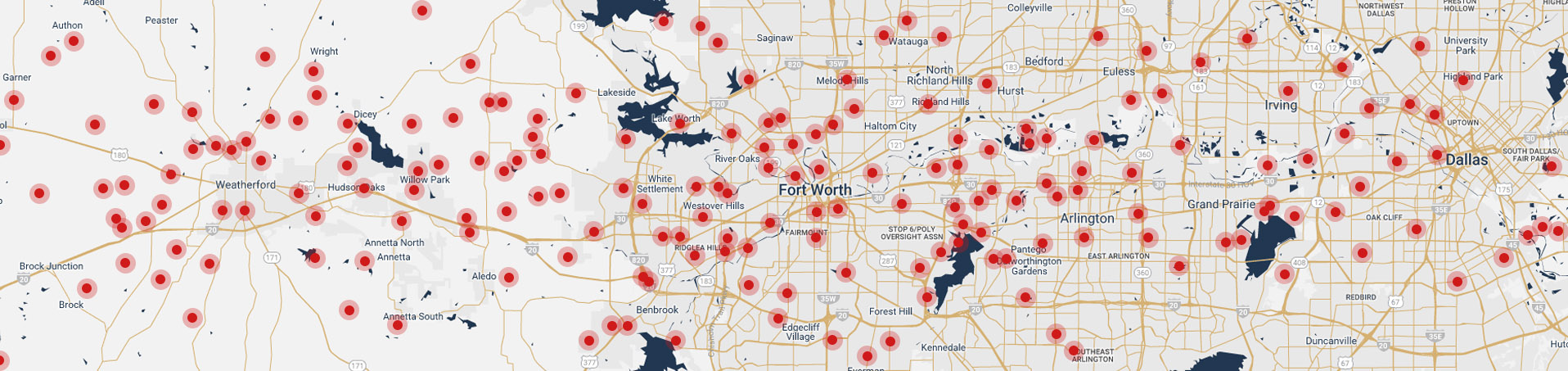

As a new property owner, you are required to pay property taxes on this real estate. It is taxed each year by a variety of jurisdictions including the county, city, and school district. As a new purchaser, you need to notify the taxing authority of your ownership so that the tax rolls will reflect the change. You may do this by contacting the appropriate tax appraisal district in your county from the following list:

- Collin County Appraisal District 469-742-9200 - www.collincad.org

- Dallas County Appraisal District 214-631-0910 - www.dallascad.org

- Denton County Appraisal District 940-349-3800 www.dentoncad.com

- Ellis County Appraisal District 972-937-3552 - www.elliscad.org

- Grayson County Appraisal District 903-893-9673 www.graysonappraisal.org

- Hunt County Appraisal District 903-454-3510 - www.hunt-cad.org

- Johnson County Appraisal District 817-648-3000 - www.johnsoncad.com

- Kaufman County Appraisal District 972-932-6081 - www.kaufman-cad.org

- Parker County Appraisal District 817-596-0077 - www.parkercad.org

- Rockwall County Appraisal District 972-771-2034 - www.rockwallcad.com

- Tarrant County Appraisal District 817-284-0024 - www.tad.org

Your property is assigned a single appraisal value, which is sent to all taxing jurisdictions. The jurisdiction then applies the tax rate, as set by its governing body, to the appraised value. In order to qualify for a residential homestead exemption you must provide the following to the Central Appraisal District when submitting your application:

A copy of the applicant’s Texas driver’s license or Texas identification certificate.

Important Note: The property address on the exemption application must match the address listed on the applicant’s Texas driver’s license/Texas identification certificate; otherwise the Chief Appraiser is prohibited from approving the exemption.

Tax Exemptions

On January 1, value, ownership, legal description of the property and exemption status of the taxpayer is determined. Several forms of tax relief are available which may reduce the taxable value of your property. Applying for exemptions is the taxpayer’s responsibility. Some exemptions require a new application each year. Contact your appraisal district to learn more about the following exemptions and how to file for them:

- General Homestead Exemption

- Agricultural Land Exemption

- Disabled Veteran Exemption

- Disabled Individual Exemption

- Over 65 Exemption

To receive your exemption(s), you must own the property and be living in the property as of January 1st. Your application must be applied for on or before April 30th to receive the tax benefits for this year. This is a free service.

Remember, tax statements are generally mailed in October of each year. The taxes are payable on or after October 31st, however, you may elect to pay them as last as January 31st without penalty. Taxes become delinquent February 1st and on this date penalties and interest do accrue. If you receive a Tax Statement and your mortgage company is escrowing funds for taxes from your monthly payments, forward the statement to your mortgage company so they can pay the taxes.

If the Central Appraisal District sends correspondence regarding your exemption, make sure to respond.

For the Buyer: Checklist for Closing

Before the closing Process: It is most helpful if the following information is handled when the Contract for Sale is delivered, or shortly thereafter.

- Provide earnest money check and a completed contract of sale to the title company. Verify to make sure all contract information is provided and accurate (phone, email, current address or preferred mailing address).

- Provide the mortgage broker and/or lender’s information for all loans. You may need to provide a copy of the contract of sale, receipted by the title company, to the mortgage company making your loan.

- Arrange through your loan officer a formal loan application

- Schedule an appointment with an inspector as soon as possible. Seller should be informed. A termite inspection may be required by the lender.

- Contact an insurance company to obtain homeowner’s insurance. This information should be sent to the title company at least one week prior to closing.

- Provide to the title company any bills to be paid at closing prior to closing.

Notify your escrow officer if you will not be in town on the closing date as you will need to follow special procedures.

Using a Power of Attorney (POA) if you will not be at the actual closing:

The POA must be approved by the title company PRIOR to closing.

You will be contacted by the title company the DAY of closing to verify that you are alive and well and have not revoked the POA.

The original is required by the title company for recording.

Provide the mortgage company’s closing instructions to the title company to prepare the Closing Disclosure/Settlement Statement. The title company cannot give you the final closing figure prior to receiving these instructions. The complete closing package from the lender must be in the hands of the title company 24 hours prior to closing in order to the meet the closing date deadline on the contract.

Required at the Closing Process, bring the following items with you to closing:

- A cashier’s check or bank wire (they do not accept money orders) made payable to the title company is required for closing funds over $1,499.

- The complete closing package from the lender.

- Please remember to bring your spouse. The lender might require their signatures on a few documents, even if not on the note.

- Bring any document requirements that your lender has requested you produce at the closing table.

After Closing, the following will be sent to you after closing - please safely store all of these documents for future reference:

- The original recorded warranty deed that transferred title of the property will be sent to you by the title company along with the owner’s title policy within 1 month after closing.

The owner’s title policy of title insurance will be mailed to you approximately 1 month after closing.

Taxes:

- Contact the County Appraisal District for assistance in making certain that the property is rendered in the current taxpayer’s name for the upcoming tax year.

- Homestead exemption: Make certain to file your homestead designation with the county appraisal district. Contact your County Appraisal District if you have questions about your homestead exemption for property tax purposes, or any other exceptions which may be available to you. The forms necessary to apply for exemptions are available at no cost from your appraisal district. You may file for property exemptions anytime between January 1st and April 30th.

Residential Service Contract (“Home Warranty”): Contact the residential service contract company directly if you received a Residential Service Contract in connection with this closing and wish to add additional coverage.

Why Title Insurance is Important for Buyers:

Real estate has traditionally been a family’s most valuable asset. It is a form of wealth that is protected by many laws. These laws have been enacted to protect one’s ownership of real estate and the improvements located on the land. The owner, the owner’s family, and the owner’s heirs have rights or claims in and to the property that you are buying. Those who have an interest in or lien upon the property could be governmental bodies, contractors, lenders, judgment creditors, the Internal Revenue Service, or various other individuals or corporations. The real estate may be sold to you without the knowledge of the party having a right or claim in and to the property.

In addition, you may purchase the real estate without having any knowledge of these rights or claims. In either event, these rights or claims remain attached to the title to the property that you are buying until they are extinguished.

The Past Can Determine Your Future:

Generally, a person thinks of insurance in terms of the payment of future loss due to the occurrence of some future event. For instance, a party obtains automobile insurance in order to pay for the future loss occasioned by a future “fender bender” or for the future theft of the car. Title insurance is a unique form of insurance. It provides coverage for future claims or future losses due to title defects which are created by some past event (i.e., event prior to the acquisition of the property). These risks are far less obvious than those protected against by automobile insurance, but can be just as devastating.

Chicotsky Real Estate Group at

Briggs Freeman Sotheby's

International Realty

3131 W 7th St. #400

Fort Worth, TX 76107

817-888-8088