Forbes Magazine recently called Fort Worth one of the best cities for rental property owners in Texas. It’s the latest in a string of attention given on the city by Forbes, who also ranked the Fort Worth as No. 4 on its Best Big Cities for Jobs list for 2017 and 2018. Job growth played a significant role in both accolades.

And Forbes is not the only notable publication turning eyes on North Texas real estate: Urban Land Institute called DFW the “top real estate market to watch,” again based on its job growth.

Specifically for rental property owners, Forbes pointed out some advantages for Fort Worth:

- The population has grown 48 percent since 2000

- The median home price is less than the US average

- Several colleges operate in the city

- The 1-year increase in home values was 10 percent

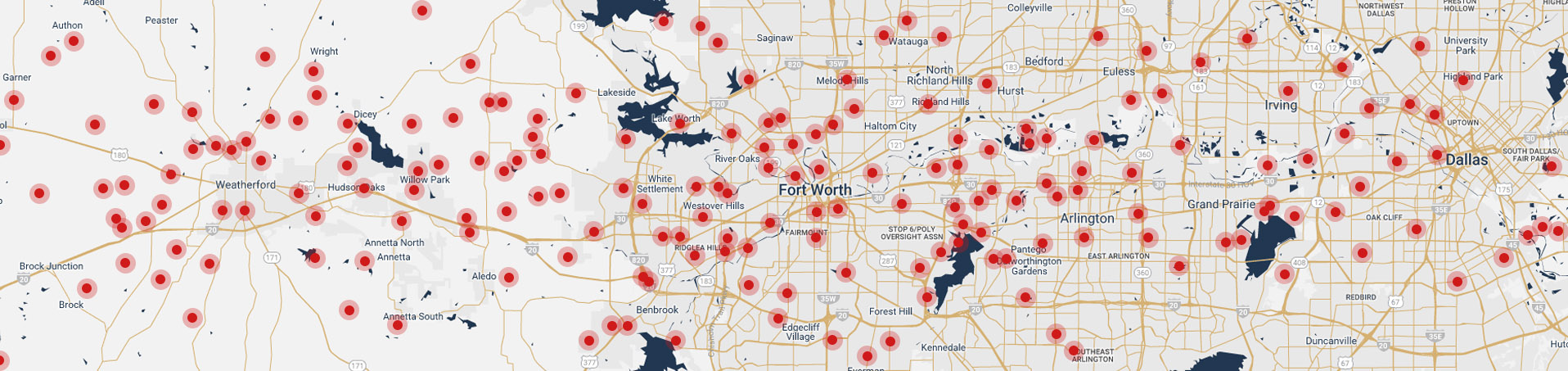

We’re going to cover what rental property owners should look for in a Fort Worth investment property, specifics about real estate investing in Fort Worth, and some of the hottest neighborhoods for rental properties.

What to Look For in an Investment Property

For new real estate investors, educating yourself about investing and the local market is important. An experienced real estate agent will be a great resource to discuss how to get started, specifics about market returns, recommending contractors, and anything else you’d like to know.

The most important rule for purchasing a real estate property with the intent to rent is to buy smart. Keep the end game in mind from day one: your purchase price plus any renovations must align with your desired profits once you exit the property. You cannot rely on appreciation alone to make gains, as rental properties have additional and sometimes unexpected expenses in maintenance and marketing.

No magic criteria exists when it comes to picking an investment property. Smart investment property owners consider the neighborhood, property size, condition, appreciation potential, and cash flow. If you’re purchasing a multifamily property, you’ll look at the cap rate and the number of units.

Gaining access and insider knowledge to this information is why it’s worth nurturing a long-term relationship with a real estate agent. This person can help you identify the best properties based on their location, potential, and cash flow. Real estate professionals keep a thumb on the pulse of the industry, use data to spot trends in up-and-coming neighborhoods, and know who might be ready to dispose of an asset.

Real Estate Investing in Fort Worth

In addition to the reasons cited by Forbes, several factors make Fort Worth an attractive rental property market.

- Population Growth. Fort Worth’s population of 812,238 ranks is no. 21 in the United States. Between 2000 and 2013, the Census Bureau found Fort Worth had the highest population growth rate in the nation, at 42 percent. In 2017, the city’s population grew 2.18%. Texas ranks third in the nation in people moving to the state from elsewhere. This steady increase in population means a continued and increased demand for all types of housing.

- Job Market. The local employment growth rate continues to meet or exceed national job growth rates. As of writing, the most recent report had a year-over-year nonfarm employment rate increase of 2.0 percent in Fort Worth-Arlington. Dallas-Fort Worth ranked third for YOY employment growth of the nation’s 12 leading metropolitan areas, beaten by Phoenix and Houston. The DFW metroplex has one in the highest concentrations of Fortune 500 company headquarters. It’s ranked fifth for the nation. New jobs will continue luring talent to the Fort Worth area, increasing housing needs.

- Student housing. Student housing remains in high demand. Fort Worth is home to Texas Christian University, plus the UNT Health Center and Texas Wesleyan University. Some parents see purchasing a home for their college student as an investment opportunity, or, are willing to pay their child’s rent. It’s up to you to evaluate the risk behind purchasing a home for student housing.

- Low inventory. Tarrant County had a 2.9-month supply of single family homes for sale in January 2019, according to North Texas Real Estate Information Systems. While about a month’s more supply over the previous year, it’s still low inventory that favors a seller’s market. Increasing sale prices and competition for the few homes available pushes people into rental properties.

- Rental rates increasing. Housing demand plays a role in rental rates. In 2017, a Fort Worth two-bedroom apartment averaged $1,140 a month, which is a 15 percent increase over four years.

Fort Worth Rental Trends

Rental prices continue increasing across Fort Worth. According to Rentcafe, which pulls data from Yardi Matrix, rental pricing has increased four percent over the previous year to $1,073. It said the average size of a Fort Worth apartment was 886 square feet.

Several neighborhoods and multifamily buildings tied for the highest reported rental average price of $1458 per month: Chamberlin Arlington Heights, Crestwood, Evans-Pearson Westwood, Factory Place, Hi Mount, Hillcrest, Linwood, Montgomery Plaza, Monticello, River Plaza Complex, Riverview Estates, Valley View, Van Zandt, and Westgate. Other notable areas with high rental averages:

- Colonial Country Club $1448

- Bellaire $1438

- Bluebonnet Hills $1438

- Colonial Hills $1438

- Overton Area $1438

- Tanglewood $1438

Of course, what a property commands for rental price varies from place to place. For instance, the fifth survey by Downtown Fort Worth found its condos, townhomes, and apartments rental prices increased 38.6 percent in a ten-year period, averaging 3.9 percent a year. Another source found a one-bedroom Fort Worth apartment averaged $1,030.

HUD’s most recent report, which stems from June 2016, placed the rental vacancy rate at seven percent, with forecasted demand far exceeding properties under construction. Note the 2016 vacancy rate was down from 11.7 percent in April 2010. Housing demand has increased seen then, so we can reasonably expect the vacancy rate to have declined or remained near the same number, despite new multifamily developments becoming available.

RealPage data shows Fort Worth has been Texas’ rental growth leader since 2015, primarily due to supply and demand economics.

Now that you know the factors at play in Fort Worth’s rental property market, let’s zero in on some areas ripe for rental property ownership.

TCU Area

The TCU Area comprises the neighborhoods Westcliff, Foster Park, Frisco Heights, Mistletoe Heights, University West, and Bluebonnet. We’ve broken down the key data for these different neighborhoods.

Westcliff

Rental rates: $985 - $4.5K

Median purchase: $354,000

Sq ft: 1,042 to 10,140sq. Ft.

Home age: 1935 to 2018

Demographics: The population of TCU-Westcliff is 36,649 with a median age of 34.8.

Foster Park

Median rental: $2,600

Median purchase: $250,000

Rental rates: $1.55K - $2.5K

Median purchase: $380,000

1,148 to 5,270sq. ft.

Home age: 1915 to 2011

Rental rates: $945 - $5.7K

Median purchase: $437,000

Sq ft: 1742 to 4,166

Home age: 1930 to 2018

Rental rates: $1.29K - $5K

Median purchase: $$324,000

Sq ft: 748 to 4,191sq. ft.

Home age: 1930 to 2017

Why the TCU Area is Attractive:

It’s close to Texas Christian University, which means its housing is in high demand from students. However, the area is home to many young professionals and families who take advantage of the area’s prime location near the cultural district, top schools, and other local amenities. Some neighborhoods are just five minutes from Sundance Square and a half-mile from the Fort Worth Zoo.

Additional Information about the Area: The Westcliff West Association and the newer Foster Park Neighborhood Association host a July 4th parade each year. Public schools include the highly rated Tanglewood Elementary plus Clayton Elementary, McLean Middle School, and Paschal High School.

Median rental: 1K - $1.75K

Median purchase: 188,250

Sqft: 973 to 9,999

Home age: 1950 to 2003

Demographics:

The South Hills Neighborhood Association defines its boundaries as between McCart Ave, I-20, Seminary Road, and Granbury Road. The median age of a South Hills resident is 30. Around 74 percent of the residents are homeowners. The crime rate is relatively low.

Why the Area is Attractive:

South Hills located south of downtown Fort Worth. It is a reasonably priced neighborhood not too far of a drive from Texas Christian University. Its southern edge is along I-20, so residents have quick access to greater Fort Worth. There are two public parks within its boundaries, and the shopping areas along Hulen St are minutes away. The area is served by South Hills Elementary and McLean Middle School.

Fairmount

Median rental: $595 - $2.7K

Median purchase: $325,000

Home age: 1904 to 2014

Square footage: 840 to 3,888sq. Ft.

Demographics:

Around 2,800 people call Fairmount home. The median resident age is 31. Around 600 of the 913 reported households are family households. The average Fairmount home was built in 1950, but a significant number were constructed earlier.

Why the Area is Attractive:

Fairmount is near Fort Worth’s center, and a few miles south of downtown. Its central location, walkability, and historic wood-framed homes make it a popular neighborhood. The neighborhood is proud of its character and hosts a Tour of Historic Homes every year. Some of the turn-of-the-century homes have been turned into charming small businesses, home to coffee shops and brewpubs, restaurants, and art galleries.

A short drive away are the Cultural District attractions, TCU, and Apple University Park Village. Residents are zoned for Clayton Elementary School and the Alice Carlson Applied Learning Center.

Southside

Median rental: $1295

Median purchase: $159,900

Home age: 1900 to 2019

Square footage: 456 to 6,074.

Demographics:

Historic Southside is home to 20,000 people with a median age of 28.5. Over half of these are families with children under 18. The average Southside home dates to the 1960s. Around 48 percent of Southside homes are renter occupied. A number of homes contribute to the area’s place on the National Register of Historic Places.

Why the Area is Attractive:

Southside has a range of residential options, from historic single-family homes to modern condominiums you’ll see along College Avenue. There is a wide range of home styles in the neighborhood.

The area draws foodies, who visit the neighborhood’s eclectic restaurant scene. Southside tends to be more pedestrian-friendly for Fort Worth. Many shops and boutiques encourage foot traffic. Cycling is popular in the area.

Southside is squeezed south of Interstate 30 and north of Interstate 20, with Highway 35 west running the eastern length. Residents quickly access the rest of Fort Worth.

The River District

Rental rates: $795-$4000

Median purchase: $407,000

Home age: 1989 to 2018

Square footage: 1,994 to 6,458

Why the Area is Attractive:

The River District undergoing substantial development. The River District’s vision is to be, “a locally-cultivated community…. offering the best of outdoor pursuits, indoor entertainment, unique restaurants, boutique office spaces, and a multitude of varying living options.” It will be the first community anchored by the Trinity River with easy access to scenic hiking and biking paths. New development includes commercial spaces, townhomes, mixed-use, and single-family homes.

Life here combines the river and its recreational opportunities with residences and retail to create a destination neighborhood. Nearby will be Crystal Springs on the River, an entertainment center with an outdoor amphitheater, music venues, restaurants, and artisan retailers. Residents are under ten minutes away from I-30 and downtown Fort Worth.

North Fort Worth

Rental rates: Ranges depend on the neighborhood

Median purchase: $114,900

Home age: 1902 to 2018

Square footage: 736 to 3,638

Demographics:

Many communities in North Fort Worth are part of Alliance Texas, one of the nation’s largest master-planned communities. Individual neighborhoods have different price points and demographics. For example, Heritage neighborhood homes list between $224,900 to $700,000 while Fossil Park ranged $205,000 to $289,900.

Why It’s Attractive:

New construction is busy in north Fort Worth is truly something to behold. It made RentCafe’s Top 10 list of trending millennial hot spots. People are turning to North Fort Worth for its newer homes, proximity to major employers, and some more education choices for their children. The master-planned Alliance Town Center offers a variety of shopping, dining, retail, and work choices. Nearby are walking trails and recreational courts. Transportation to greater Fort Worth is accessible from I-820 and I-35W. If interested in North Fort Worth as a rental property option, you’ll want to learn more about the area and consult with a real estate professional.

Finding the Right Advice

While you can't predict with 100% accuracy where the real estate market is going to go, you can know where it's at today. Combined with experience in Fort Worth real estate, you can make educated guesses about which rental properties make the most sense for your investment goals.

Working with someone who understands real estate investment and property ownership will help you make smart decisions. Even if you are experienced, it’s always a good idea to sit down with your local real estate professional to discuss trends the real estate market, especially with concern to rental property ownership.

Currently, Fort Worth’s low inventory and high demand are major market drivers. Finding a investment property is more challenging, but with the right knowledge, you can find viable opportunities to build your portfolio.

At Chicotsky Real Estate Group, we have a vested interest in our community’s success as generational Fort Worth residents. We serve as active board Camp Bowie District members, property owners, and real estate professionals. Our goal is to help clients succeed at their real estate goals. For rental property owners, that means securing the best deal possible in high demand areas.